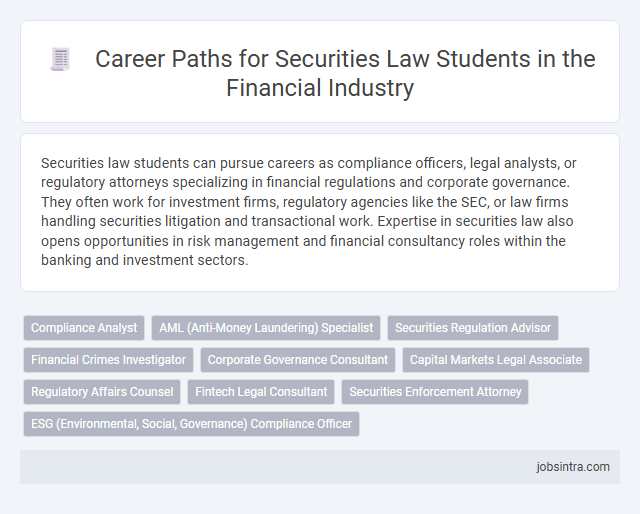

Securities law students can pursue careers as compliance officers, legal analysts, or regulatory attorneys specializing in financial regulations and corporate governance. They often work for investment firms, regulatory agencies like the SEC, or law firms handling securities litigation and transactional work. Expertise in securities law also opens opportunities in risk management and financial consultancy roles within the banking and investment sectors.

Compliance Analyst

Securities Law students pursuing a career as Compliance Analysts play a crucial role in ensuring that financial institutions and corporations adhere to regulatory requirements and internal policies. They monitor transactions, analyze potential risks, and prepare detailed reports to prevent violations of securities laws. This position demands strong analytical skills, attention to detail, and a thorough understanding of regulatory frameworks such as the SEC and FINRA.

AML (Anti-Money Laundering) Specialist

Securities law students specializing as AML (Anti-Money Laundering) Specialists play a critical role in detecting and preventing financial crimes within financial institutions and regulatory bodies. They ensure compliance with legal frameworks by conducting thorough investigations, analyzing suspicious transactions, and implementing risk management strategies. Expertise in AML regulations and securities law positions these professionals to safeguard market integrity and support institutional adherence to anti-fraud measures.

Securities Regulation Advisor

Securities Law students can excel as Securities Regulation Advisors, guiding businesses through complex compliance requirements and ensuring adherence to federal and state securities laws. This role involves analyzing regulatory changes, preparing disclosure documents, and advising on legal risks related to securities transactions. Your expertise in securities regulation helps companies navigate legal challenges and maintain investor confidence.

Financial Crimes Investigator

Financial Crimes Investigators analyze complex financial data to uncover fraud, money laundering, and other illegal activities within securities markets. You will leverage your understanding of securities law to ensure compliance and assist in prosecuting financial offenses. This role requires strong analytical skills and attention to detail to protect investors and maintain market integrity.

Corporate Governance Consultant

Corporate Governance Consultants specialize in advising companies on compliance with securities regulations and best practices for board oversight. Their role involves assessing corporate policies, ensuring transparency in financial reporting, and guiding firms through regulatory changes. This position is ideal for Securities Law students seeking to apply legal knowledge to enhance corporate accountability and investor confidence.

Capital Markets Legal Associate

Securities law students seeking careers as Capital Markets Legal Associates typically engage in drafting and reviewing documents for initial public offerings (IPOs), bond issuances, and other securities transactions. They provide legal advice on regulatory compliance with the Securities and Exchange Commission (SEC) and other governing bodies to ensure smooth capital raising processes. These roles demand strong analytical skills and a thorough understanding of securities regulations to mitigate legal risks for financial institutions and corporations.

Regulatory Affairs Counsel

Regulatory Affairs Counsel play a critical role in navigating the complex legal frameworks governing securities and financial markets. Your expertise in securities law ensures compliance with regulatory requirements, guiding organizations through filings, disclosures, and enforcement actions. This position demands strong analytical skills and a keen understanding of financial regulations to support corporate governance and risk management.

Fintech Legal Consultant

Fintech Legal Consultants specialize in navigating the complex regulatory landscape surrounding financial technologies, ensuring compliance with securities laws and industry standards. They provide crucial guidance on issues such as digital asset offerings, blockchain regulations, and payment system compliance. Their expertise helps fintech companies innovate while mitigating legal risks associated with securities transactions and financial regulations.

Securities Enforcement Attorney

A career as a Securities Enforcement Attorney offers opportunities to investigate and prosecute violations of securities laws, ensuring market integrity and investor protection. This role involves working closely with regulatory bodies such as the SEC to enforce compliance and litigate cases involving fraud, insider trading, and other securities-related offenses. Your expertise in securities law equips you to navigate complex legal frameworks and advocate effectively in highly specialized enforcement proceedings.

Good to know: jobs for Securities Law students

Overview of Securities Law in the Financial Industry

Securities Law governs the regulation of financial markets and investment instruments, ensuring transparency and protecting investors. It plays a critical role in maintaining the integrity of capital markets and enforcing compliance with federal securities statutes.

Students specializing in Securities Law can pursue careers as compliance officers, legal analysts, or regulatory advisors within financial institutions. These roles focus on interpreting complex securities regulations, advising on corporate disclosures, and managing risks related to market transactions. Opportunities also exist in government agencies such as the Securities and Exchange Commission (SEC) and in law firms specializing in financial litigation and regulatory enforcement.

Essential Skills for Aspiring Securities Lawyers

Securities law students have diverse career opportunities within legal firms, regulatory bodies, and corporate environments. Mastering essential skills is crucial for success in these dynamic roles.

- Analytical Thinking - You must interpret complex regulations and identify legal risks accurately.

- Attention to Detail - Precision is necessary when drafting disclosures and reviewing compliance documents.

- Communication Skills - Clear writing and persuasive argumentation are vital for client advisories and litigation.

Developing these skills will prepare you for a rewarding career in securities law.

Law Firm Roles: Securities Litigation and Regulatory Practice

Students specializing in Securities Law can pursue careers in law firms focusing on Securities Litigation, where they handle cases involving securities fraud, insider trading, and shareholder disputes. Regulatory Practice roles involve advising clients on compliance with securities regulations enforced by bodies like the SEC and FINRA. These positions demand strong analytical skills and a deep understanding of federal securities laws and regulatory frameworks.

Careers in Regulatory Agencies and Government

What career opportunities exist for Securities Law students in regulatory agencies and government? Students specializing in Securities Law can pursue positions such as compliance analysts, financial examiners, and policy advisors within agencies like the SEC or FINRA. These roles involve enforcing securities regulations, investigating violations, and shaping financial policy to ensure market integrity.

In-House Counsel Opportunities at Financial Institutions

| Job Role | Description | Key Responsibilities | Required Skills | Employers |

|---|---|---|---|---|

| In-House Counsel - Securities Law | Legal expert specializing in securities regulation, compliance, and corporate governance within financial institutions. |

|

|

Major banks, investment firms, insurance companies, asset management companies, credit unions |

| Compliance Counsel - Financial Institutions | Legal adviser focused on ensuring compliance with securities laws and financial regulations within banking and investment institutions. |

|

|

Commercial banks, brokerage firms, credit rating agencies, financial service providers |

| Transaction Counsel - Securities | Specialist lawyer guiding financial institutions through securities transactions, including public offerings and private placements. |

|

|

Investment banks, securities firms, corporate finance departments in financial institutions |

| Regulatory Affairs Counsel | Legal professional managing interaction between financial institutions and regulatory agencies concerning securities laws. |

|

|

Financial institutions, regulatory bodies, consultancy firms specializing in financial law |

Non-Traditional and Compliance Careers for Securities Law Graduates

Securities Law students possess specialized knowledge that opens pathways beyond traditional legal roles. Exploring non-traditional and compliance careers can maximize the use of your expertise in varied sectors.

- Regulatory Compliance Officer - Oversee adherence to securities regulations within financial institutions to minimize legal and regulatory risks.

- Corporate Governance Specialist - Advise companies on best practices related to securities laws, ensuring transparency and ethical management.

- Financial Crime Analyst - Investigate and prevent fraud and insider trading by applying securities law knowledge in financial institutions and regulatory bodies.

Tips for Building a Successful Securities Law Career

Students specializing in Securities Law can pursue diverse roles such as compliance analyst, securities litigation associate, corporate counsel, or regulatory advisor. These positions often involve working with financial regulations, SEC filings, and corporate governance issues.

Networking with industry professionals and gaining internships at law firms or regulatory bodies enhances practical experience and industry knowledge. Staying updated on evolving securities regulations and developing strong analytical skills are essential for career advancement.

jobsintra.com

jobsintra.com