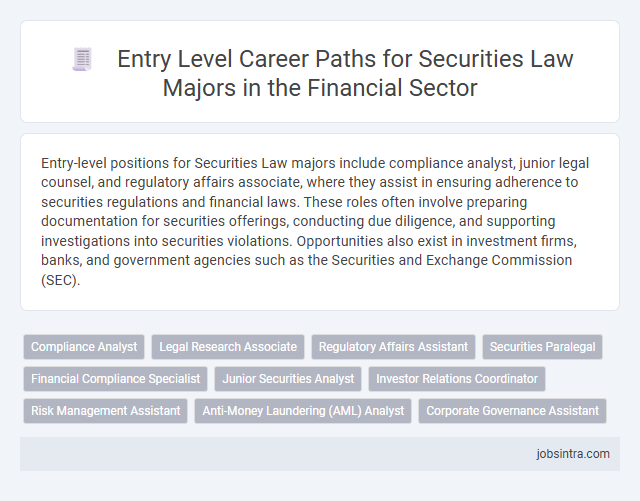

Entry-level positions for Securities Law majors include compliance analyst, junior legal counsel, and regulatory affairs associate, where they assist in ensuring adherence to securities regulations and financial laws. These roles often involve preparing documentation for securities offerings, conducting due diligence, and supporting investigations into securities violations. Opportunities also exist in investment firms, banks, and government agencies such as the Securities and Exchange Commission (SEC).

Compliance Analyst

A Compliance Analyst plays a crucial role in ensuring that financial institutions adhere to securities laws and regulations, minimizing legal risks and maintaining ethical standards. You will monitor transactions, conduct audits, and assess internal policies to ensure they align with current regulatory requirements. Entry-level positions often require strong analytical skills, attention to detail, and a solid understanding of securities legislation and compliance frameworks.

Legal Research Associate

Legal Research Associates in securities law focus on analyzing regulations, drafting legal memos, and supporting attorneys in compliance and litigation matters related to securities markets. They conduct detailed examinations of securities statutes, case law, and regulatory policies to assist in developing legal strategies and ensuring adherence to financial laws. This entry-level role provides critical experience in interpreting complex securities regulations and contributes to safeguarding market integrity.

Regulatory Affairs Assistant

Regulatory Affairs Assistant positions are ideal entry-level jobs for Securities Law majors, offering hands-on experience with compliance and regulatory filings. You will support legal teams by reviewing documentation and ensuring adherence to securities laws and regulations. This role provides a solid foundation in understanding regulatory frameworks and corporate governance in the financial sector.

Securities Paralegal

Securities paralegals assist attorneys by conducting regulatory research, preparing filings with the Securities and Exchange Commission (SEC), and maintaining compliance documentation. They play a crucial role in drafting prospectuses, analyzing financial disclosures, and supporting securities litigation cases. Entry-level roles often require strong knowledge of securities laws, attention to detail, and proficiency with legal research tools.

Financial Compliance Specialist

Financial Compliance Specialists play a crucial role in ensuring organizations adhere to securities laws and regulations, protecting investors and maintaining market integrity. Your expertise in regulatory frameworks enables you to monitor transactions, assess risks, and implement policies that prevent violations. Entry-level positions often involve supporting audits, preparing compliance reports, and collaborating with legal teams to navigate complex securities requirements.

Junior Securities Analyst

Junior Securities Analysts in securities law support senior analysts by conducting thorough research on market trends, regulatory developments, and financial statements to ensure compliance with securities regulations. They assist in preparing detailed reports and evaluations that help law firms and financial institutions navigate complex securities transactions and enforcement actions. This entry-level position offers valuable experience in analyzing legal and financial data, essential for advancing in securities law careers.

Investor Relations Coordinator

An entry-level Investor Relations Coordinator plays a crucial role in managing communication between a company and its investors, ensuring transparency and trust. Your background in Securities Law equips you with a strong understanding of regulatory compliance and financial disclosures, essential for crafting accurate and compliant investor reports. This role offers valuable experience in both finance and corporate communication, paving the way for a successful career in investor relations or securities compliance.

Risk Management Assistant

Risk Management Assistants in securities law help identify and analyze potential financial risks related to securities transactions and regulatory compliance. They support the development of risk mitigation strategies by monitoring market conditions, reviewing legal documents, and ensuring adherence to securities regulations. This role requires strong analytical skills and a deep understanding of securities laws to assist in protecting firms from regulatory penalties and financial losses.

Anti-Money Laundering (AML) Analyst

Entry-level Securities Law majors can pursue roles as Anti-Money Laundering (AML) Analysts, where they monitor financial transactions for suspicious activity and ensure compliance with regulatory requirements. Your analytical skills and understanding of securities regulations help detect and prevent money laundering and terrorist financing. This role offers a strong foundation in risk management and regulatory enforcement within financial institutions.

Good to know: jobs for Securities Law majors entry level

Overview of Securities Law in the Financial Sector

Securities Law governs the regulation of financial markets and the issuance of securities, ensuring transparency and investor protection. Entry-level positions for Securities Law majors typically involve compliance, regulatory analysis, and corporate governance within financial institutions.

Common job roles include junior compliance analyst, legal assistant in securities firms, and regulatory affairs associate. These roles focus on monitoring transactions, preparing legal documentation, and supporting adherence to SEC regulations and financial statutes.

Key Skills and Qualifications for Entry-Level Roles

Entry-level jobs for Securities Law majors often include roles such as compliance analyst, legal assistant, and junior associate in law firms or financial institutions. These positions require a strong foundation in securities regulations and the ability to assist with the analysis of legal documents and regulatory filings.

- Knowledge of Securities Regulations - Understanding key laws like the Securities Act of 1933 and the Securities Exchange Act of 1934 is essential for compliance and advisory roles.

- Analytical Skills - Ability to interpret complex financial data and legal documents to support decision-making and risk assessment.

- Attention to Detail - Precision in reviewing contracts, disclosures, and regulatory submissions helps ensure compliance and avoid legal risks.

Top Entry-Level Job Titles for Securities Law Graduates

Securities Law majors have a variety of entry-level job opportunities in the legal and financial sectors. These positions focus on regulatory compliance, financial transactions, and legal research related to securities and financial markets.

Top entry-level job titles for Securities Law graduates include Securities Compliance Analyst, Legal Assistant for Securities Transactions, and Junior Regulatory Analyst. These roles involve supporting legal teams with reviewing and drafting compliance documents, conducting due diligence, and assisting in enforcement actions under laws like the Securities Act of 1933 and the Securities Exchange Act of 1934. Employers often include law firms, financial institutions, regulatory agencies such as the SEC, and corporate legal departments focused on securities regulations.

Regulatory Agencies and Institutions Hiring Securities Law Majors

Securities Law majors have numerous entry-level job opportunities within regulatory agencies and institutions overseeing financial markets. These roles offer direct experience in enforcing laws and ensuring market transparency.

You can pursue positions at agencies such as the Securities and Exchange Commission (SEC) or the Financial Industry Regulatory Authority (FINRA). These institutions seek candidates knowledgeable in securities regulations to support compliance, investigations, and policy development.

Career Growth and Advancement Opportunities

Entry-level positions for Securities Law majors include compliance analyst, legal assistant, and junior regulatory affairs specialist. These roles provide foundational experience in financial regulations, securities transactions, and corporate governance. Your career growth can lead to senior counsel, compliance director, or regulatory affairs manager, with opportunities to specialize in areas like securities litigation or policy advisory.

Required Certifications and Professional Licenses

Entry-level jobs for Securities Law majors require specific certifications and professional licenses to ensure compliance with financial regulations. Your qualifications significantly influence opportunities in legal advisory, compliance, and regulatory roles within the securities industry.

- Series 7 License - Allows you to sell a broad range of securities and is often required for broker-dealer roles.

- Series 63 License - Enables you to operate as a securities agent within individual states, ensuring state regulation compliance.

- Compliance Certification - Certifications like Certified Regulatory and Compliance Professional (CRCP) enhance your credibility in securities law compliance positions.

Tips for Navigating the Financial Sector Job Market

Entry-level jobs for Securities Law majors often involve roles in regulatory compliance, legal analysis, and financial advisory within the financial sector. Understanding key industry requirements and building relevant skills enhances job market navigation for new graduates in this field.

- Focus on Regulatory Compliance Roles - These positions ensure organizations adhere to securities laws and financial regulations, providing crucial experience for career advancement.

- Build Strong Analytical Skills - Proficiency in analyzing financial documents and legal statutes is essential for roles such as legal analyst or junior counsel in securities firms.

- Network within Financial Institutions - Connecting with professionals in banks, investment firms, and regulatory bodies can uncover hidden job opportunities and mentorship.

Developing specialized knowledge of securities regulations and gaining practical experience through internships significantly improves prospects in the financial sector job market.

jobsintra.com

jobsintra.com