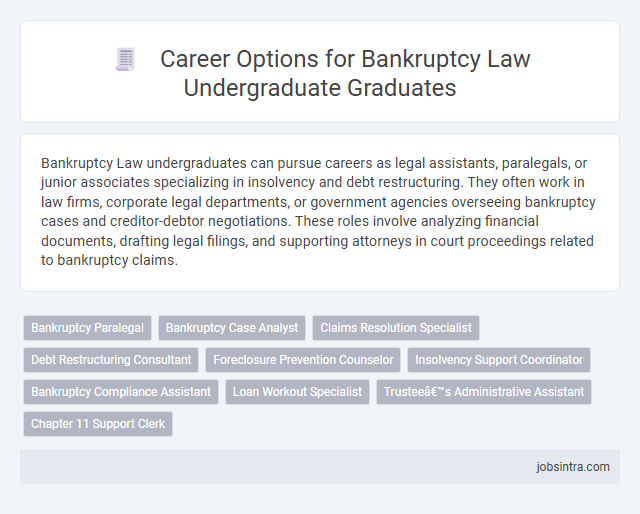

Bankruptcy Law undergraduates can pursue careers as legal assistants, paralegals, or junior associates specializing in insolvency and debt restructuring. They often work in law firms, corporate legal departments, or government agencies overseeing bankruptcy cases and creditor-debtor negotiations. These roles involve analyzing financial documents, drafting legal filings, and supporting attorneys in court proceedings related to bankruptcy claims.

Bankruptcy Paralegal

A Bankruptcy Paralegal plays a crucial role in supporting attorneys by preparing legal documents, organizing case files, and conducting research on bankruptcy laws and procedures. This position requires strong knowledge of bankruptcy codes, attention to detail, and excellent communication skills to assist clients effectively during financial distress. Your expertise in managing deadlines and liaising with creditors and courts ensures smooth case management and accurate filings.

Bankruptcy Case Analyst

Bankruptcy Case Analysts play a crucial role in evaluating and managing financial distress situations by scrutinizing case files, financial statements, and legal documents to support bankruptcy proceedings. Their work helps streamline case preparation and ensures compliance with bankruptcy laws, making them valuable assets in law firms, financial institutions, and government agencies. Your expertise in Bankruptcy Law equips you with the analytical skills necessary to assist in restructuring efforts and creditor negotiations.

Claims Resolution Specialist

A Claims Resolution Specialist in bankruptcy law is responsible for evaluating and processing creditor claims to ensure accurate recovery distribution during bankruptcy proceedings. They analyze financial documents, verify claim validity, and communicate with stakeholders to resolve disputes efficiently. Expertise in bankruptcy regulations and strong attention to detail are essential for success in this role.

Debt Restructuring Consultant

A Debt Restructuring Consultant specializes in advising financially distressed companies on how to reorganize their debt to improve cash flow and avoid bankruptcy. They analyze financial statements, negotiate with creditors, and develop strategic repayment plans tailored to the company's unique situation. This role requires strong knowledge of bankruptcy law, negotiation skills, and financial acumen to guide clients through complex restructuring processes.

Foreclosure Prevention Counselor

Foreclosure prevention counselors work closely with homeowners facing financial hardship to develop actionable plans that help avoid losing their homes. These professionals analyze clients' financial situations, negotiate with lenders, and provide guidance on loan modifications or alternative solutions. Your expertise in bankruptcy law is invaluable in advising clients on legal options to protect their property rights and stabilize their financial future.

Insolvency Support Coordinator

An Insolvency Support Coordinator plays a crucial role in managing the administration of bankruptcies and ensuring compliance with legal requirements. You will assist in coordinating communication between creditors, debtors, and legal professionals to streamline insolvency proceedings. This position requires a strong understanding of bankruptcy laws and excellent organizational skills to support effective case management.

Bankruptcy Compliance Assistant

Bankruptcy Compliance Assistants play a crucial role in supporting law firms and financial institutions by ensuring adherence to bankruptcy laws and regulations. This position involves monitoring case documentation, maintaining accurate records, and assisting attorneys in preparing legal paperwork related to bankruptcy filings. Your attention to detail and understanding of bankruptcy procedures are essential for helping organizations navigate complex compliance requirements efficiently.

Loan Workout Specialist

Loan Workout Specialists in bankruptcy law review distressed loan portfolios to develop restructuring plans that maximize creditor recovery while minimizing losses. They negotiate repayment terms with borrowers, analyze financial statements, and ensure compliance with bankruptcy regulations to facilitate successful loan modifications or settlements. Their expertise in both legal frameworks and financial analysis makes them key players in managing troubled debt and mitigating risk for lending institutions.

Trustee’s Administrative Assistant

A Trustee's Administrative Assistant supports bankruptcy trustees by managing case files, scheduling meetings, and coordinating communication with creditors and debtors. This role requires strong organizational skills and a thorough understanding of bankruptcy procedures to ensure efficient case administration. Your ability to handle confidential information and maintain accurate records is essential for maintaining compliance and supporting the trustee's responsibilities.

Good to know: jobs for Bankruptcy Law undergraduate

Overview of Bankruptcy Law as a Legal Field

Bankruptcy law governs the legal process by which individuals or businesses unable to meet their financial obligations seek relief from some or all of their debts. This field encompasses restructuring, liquidation, and debtor-creditor negotiations under the protection of federal bankruptcy courts.

- Bankruptcy Attorney - Specializes in advising and representing clients in filing for bankruptcy and navigating proceedings under chapters such as Chapter 7, 11, or 13.

- Credit Analyst - Evaluates the creditworthiness of individuals and businesses facing financial distress to assist lenders and investors in decision-making.

- Bankruptcy Trustee - Appointed to administer bankruptcy cases by managing asset liquidation and distribution to creditors in compliance with legal requirements.

Careers in bankruptcy law require strong analytical skills, comprehensive understanding of insolvency regulations, and the ability to negotiate complex financial settlements.

Key Skills Gained from a Bankruptcy Law Degree

An undergraduate degree in Bankruptcy Law equips students with critical analytical skills to assess financial distress and insolvency cases. Graduates develop expertise in legal research, contract analysis, and negotiation, essential for advising clients on debt restructuring and bankruptcy proceedings. Career opportunities include roles as bankruptcy analysts, legal advisors, and compliance officers in law firms, financial institutions, and government agencies.

Traditional Career Paths for Bankruptcy Law Graduates

| Career Path | Job Description | Key Skills |

|---|---|---|

| Bankruptcy Attorney | Represent clients in bankruptcy proceedings, advise on debt restructuring, and navigate insolvency laws. | Litigation, negotiation, legal research, knowledge of bankruptcy codes |

| Corporate Restructuring Consultant | Assist companies facing financial distress with reorganization strategies to avoid bankruptcy. | Financial analysis, strategic planning, understanding of insolvency frameworks |

| Credit Analyst | Assess financial status of individuals or companies to determine credit risk, often within banking and lending institutions. | Financial modeling, risk assessment, bankruptcy law awareness |

| Bankruptcy Trustee | Manage debtor's estate during bankruptcy process, oversee asset liquidation and distribution to creditors. | Regulatory compliance, asset management, legal administration |

| Insolvency Practitioner | Offer expert advice and services relating to insolvency, including administration, liquidation, and restructuring. | Insolvency law expertise, negotiation, financial advisory |

| Legal Advisor in Financial Institutions | Provide guidance on bankruptcy and insolvency risks impacting loans and investments. | Bankruptcy law, contract law, risk management |

| Judicial Clerk for Bankruptcy Courts | Support judges by researching legal precedents and preparing case materials specifically related to bankruptcy law. | Legal research, writing, attention to detail, bankruptcy law knowledge |

You can leverage your undergraduate background in bankruptcy law to pursue these traditional career roles. Each path requires specialized knowledge of insolvency and financial regulations.

Emerging Roles in Bankruptcy and Restructuring

Bankruptcy Law undergraduates can explore emerging roles in financial restructuring, insolvency analysis, and compliance advisory services. These positions often involve working with distressed companies to develop turnaround strategies or assisting creditors during bankruptcy proceedings. Your skills in negotiation, financial assessment, and legal research make you valuable in navigating complex restructuring cases and emerging insolvency frameworks.

Non-Legal Careers Utilizing Bankruptcy Law Expertise

Bankruptcy Law undergraduates possess unique skills that extend beyond traditional legal careers. Your expertise can open doors to diverse non-legal professions where understanding financial distress and restructuring is crucial.

- Financial Analyst - Analyze company financial health and assess risks related to bankruptcy and restructuring processes.

- Credit Risk Manager - Evaluate creditworthiness and develop strategies to mitigate risks associated with insolvent clients.

- Corporate Restructuring Consultant - Advise businesses on turnaround strategies and debt negotiation without practicing law.

Essential Certifications and Further Education

What career opportunities are available for a Bankruptcy Law undergraduate? Bankruptcy Law graduates can pursue roles such as bankruptcy analysts, legal consultants, or paralegals specializing in insolvency cases. Essential certifications like the Certified Insolvency and Restructuring Advisor (CIRA) enhance job prospects significantly.

How important is further education in advancing a Bankruptcy Law career? Obtaining a Master of Laws (LL.M.) in Bankruptcy or Commercial Law deepens expertise and opens doors to higher-level positions. Certificates in Financial Analysis and Mediation also support professional growth within this legal specialization.

Tips for Launching a Successful Bankruptcy Law Career

Graduates with an undergraduate degree in Bankruptcy Law can pursue careers as bankruptcy attorneys, legal consultants, or paralegals specializing in insolvency cases. These roles require strong analytical skills and a deep understanding of bankruptcy statutes and procedures.

To launch a successful bankruptcy law career, focus on gaining practical experience through internships at law firms or financial institutions. Building a network with professionals in bankruptcy law can open doors to valuable job opportunities. Continuous learning about recent changes in bankruptcy regulations enhances your expertise and employability.

jobsintra.com

jobsintra.com