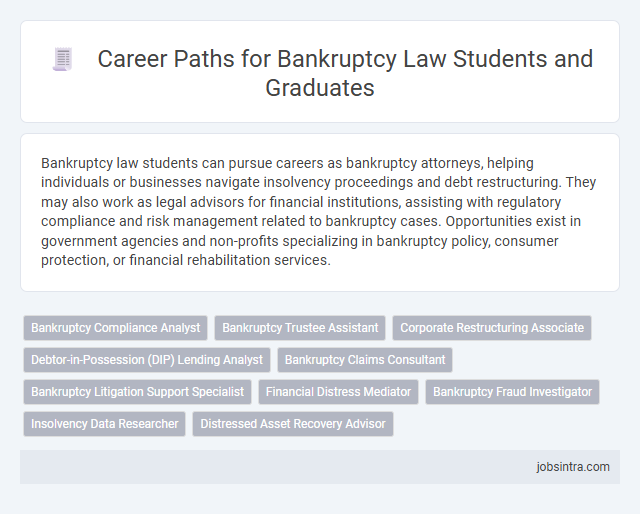

Bankruptcy law students can pursue careers as bankruptcy attorneys, helping individuals or businesses navigate insolvency proceedings and debt restructuring. They may also work as legal advisors for financial institutions, assisting with regulatory compliance and risk management related to bankruptcy cases. Opportunities exist in government agencies and non-profits specializing in bankruptcy policy, consumer protection, or financial rehabilitation services.

Bankruptcy Compliance Analyst

Bankruptcy Law students can advance their careers as Bankruptcy Compliance Analysts by ensuring organizations adhere to legal and regulatory requirements throughout insolvency proceedings. This role involves analyzing financial documents, monitoring compliance with bankruptcy codes, and preparing detailed reports to support legal teams and stakeholders. Strong analytical skills and thorough knowledge of bankruptcy laws are essential for successfully mitigating risks and facilitating smooth case resolutions.

Bankruptcy Trustee Assistant

Bankruptcy law students can excel as Bankruptcy Trustee Assistants, supporting trustees in managing debtor estates and evaluating financial documents. This role involves organizing case files, communicating with creditors, and assisting in asset liquidation processes. Gaining hands-on experience as a trustee assistant sharpens skills in legal research, financial analysis, and case management essential for a future career in bankruptcy law.

Corporate Restructuring Associate

Corporate restructuring associates specialize in advising financially troubled companies on reorganizing their debts and operations to restore profitability. They analyze complex financial documents, negotiate with creditors, and develop strategic plans to facilitate successful bankruptcy proceedings or out-of-court settlements. This role demands strong analytical skills, knowledge of insolvency laws, and the ability to manage high-pressure negotiations.

Debtor-in-Possession (DIP) Lending Analyst

A Debtor-in-Possession (DIP) Lending Analyst plays a crucial role in bankruptcy cases by evaluating and structuring financing solutions for companies undergoing reorganization. This position requires strong analytical skills to assess risk, compliance with bankruptcy regulations, and the ability to work closely with financial institutions and legal teams. Your expertise in bankruptcy law can help navigate complex financial scenarios, ensuring viable funding avenues during a company's distressed phase.

Bankruptcy Claims Consultant

Bankruptcy Claims Consultants analyze and evaluate claims in insolvency cases to ensure accurate filing and maximize recoveries for creditors. Your expertise in bankruptcy law enables you to navigate complex financial documents, identify valid claims, and provide strategic guidance during debt restructuring. This role demands attention to detail and strong analytical skills, making it ideal for law students specializing in bankruptcy.

Bankruptcy Litigation Support Specialist

Bankruptcy Law students can pursue careers as Bankruptcy Litigation Support Specialists, providing critical assistance in the preparation and analysis of case documents for court proceedings. They play a vital role in managing financial records, organizing evidence, and supporting attorneys during bankruptcy litigations. Expertise in legal research and familiarity with bankruptcy codes enhances their effectiveness in resolving complex insolvency disputes.

Financial Distress Mediator

A Financial Distress Mediator specializes in resolving conflicts between debtors and creditors during bankruptcy proceedings, ensuring fair negotiations and settlements. This role demands a deep understanding of bankruptcy law, financial analysis, and strong communication skills to facilitate agreements that prevent insolvency or expedite restructuring. Career opportunities for Bankruptcy Law students include working with law firms, financial institutions, or government agencies focused on insolvency resolution.

Bankruptcy Fraud Investigator

Bankruptcy Fraud Investigators play a crucial role in uncovering fraudulent activities during bankruptcy proceedings by meticulously examining financial records and transactions. This job requires strong analytical skills and knowledge of bankruptcy laws to detect misrepresentation or concealment of assets. Opportunities often exist within government agencies, private law firms, and financial institutions focused on enforcing bankruptcy regulations and protecting creditors' interests.

Insolvency Data Researcher

An Insolvency Data Researcher plays a crucial role in analyzing financial data related to bankruptcies and insolvencies, helping law firms and financial institutions make informed decisions. Your expertise in interpreting complex datasets, tracking bankruptcy trends, and evaluating creditor and debtor information supports case strategies and risk assessments. This position demands strong analytical skills and a deep understanding of insolvency laws to influence legal outcomes effectively.

Good to know: jobs for Bankruptcy Law students

Overview of Bankruptcy Law as a Career

Bankruptcy law involves the legal processes and regulations surrounding insolvency cases for individuals and businesses. Students specializing in bankruptcy law can pursue careers as bankruptcy attorneys, trustees, or legal consultants, helping clients navigate debt relief and asset protection. This field offers opportunities in law firms, financial institutions, government agencies, and corporate legal departments focused on restructuring and insolvency.

Essential Skills for Bankruptcy Law Professionals

Bankruptcy law students can pursue careers as bankruptcy attorneys, legal analysts, or financial restructuring consultants. These roles require a deep understanding of insolvency regulations and debtor-creditor relationships.

Essential skills for bankruptcy law professionals include strong analytical abilities to assess complex financial documents. Effective communication skills are crucial for negotiating settlements and explaining legal options to clients.

Typical Roles for Bankruptcy Law Graduates

What career opportunities are available for graduates specializing in Bankruptcy Law? Typical roles for Bankruptcy Law graduates include positions such as bankruptcy attorneys, restructuring consultants, and insolvency analysts. These roles focus on advising clients on debt resolution, managing bankruptcy cases, and negotiating with creditors.

How do Bankruptcy Law graduates contribute in legal firms? Many graduates work as legal associates in law firms that specialize in insolvency and financial distress cases. They prepare legal documents, represent clients in bankruptcy proceedings, and assist in asset liquidation processes.

What roles exist beyond the traditional law firm setting for Bankruptcy Law students? Graduates can also find opportunities in corporate restructuring departments of large companies and government agencies overseeing bankruptcy regulations. Your expertise helps navigate complex financial situations and ensures compliance with bankruptcy laws.

Are there specialized positions in financial institutions for Bankruptcy Law graduates? Yes, roles such as credit risk analysts or loan workout specialists are common in banks and financial institutions. These professionals assess borrower insolvency risks and develop strategies for debt recovery.

Can Bankruptcy Law graduates work in advisory and consultancy services? Bankruptcy Law professionals often join consulting firms providing advisory services in insolvency and debt management. Their knowledge supports businesses and creditors in making informed decisions during financial distress.

Work Environments for Bankruptcy Lawyers

| Job Role | Work Environment | Key Responsibilities | Relevant Employers |

|---|---|---|---|

| Bankruptcy Attorney | Law Firms specializing in bankruptcy and insolvency law | Represent clients in bankruptcy filings, negotiate debt settlements, and provide legal advice on insolvency matters | Corporate law firms, boutique bankruptcy firms |

| In-House Counsel | Corporate legal departments of financially distressed companies | Advise company management on restructuring, compliance with bankruptcy laws, and risk mitigation | Corporations undergoing restructuring or financial challenges |

| Bankruptcy Trustee | Government agencies or court-appointed positions | Administer bankruptcy cases, oversee asset liquidation, and distribute proceeds to creditors | U.S. Bankruptcy Courts, Department of Justice |

| Financial Restructuring Consultant | Consulting firms and advisory services specializing in insolvency | Develop restructuring plans, advise on debt management strategies, collaborate with legal teams | Management consulting firms, financial advisory companies |

| Academic or Legal Researcher | Universities and legal research institutes | Conduct research on bankruptcy law developments, publish scholarly articles, contribute to legal education | Law schools, research centers focused on commercial and insolvency law |

Advancement and Specialization Opportunities

Bankruptcy law students can pursue careers as bankruptcy attorneys, financial restructuring advisors, or insolvency analysts. Specialization opportunities include focusing on consumer bankruptcy, corporate restructuring, or bankruptcy litigation. Advancement often leads to roles such as senior counsel, bankruptcy judge, or legal consultant for corporate clients, enhancing your expertise and professional growth.

Networking and Professional Organizations

Bankruptcy law students can advance their careers by engaging with professional networks and specialized organizations. Building connections within these circles enhances job prospects and industry knowledge.

- Join the American Bankruptcy Institute - Access cutting-edge research, webinars, and events tailored to bankruptcy law professionals.

- Participate in Local Bar Association Bankruptcy Committees - Network with attorneys and judges to gain insight and referrals in your regional legal market.

- Attend Legal Career Fairs Focused on Bankruptcy Law - Connect directly with law firms and corporate legal departments recruiting bankruptcy specialists.

Tips for Breaking Into Bankruptcy Law

Bankruptcy law students can pursue roles such as bankruptcy associate, legal analyst, or restructuring consultant. Gaining experience through internships at law firms or financial institutions specializing in bankruptcy enhances career prospects.

Networking with professionals in bankruptcy law and joining related legal organizations can provide valuable insights and job leads. Developing strong analytical and negotiation skills is essential for success in this specialized legal field.

jobsintra.com

jobsintra.com