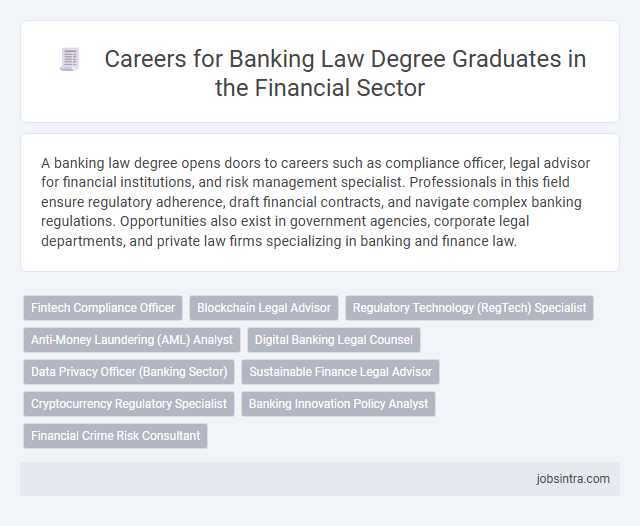

A banking law degree opens doors to careers such as compliance officer, legal advisor for financial institutions, and risk management specialist. Professionals in this field ensure regulatory adherence, draft financial contracts, and navigate complex banking regulations. Opportunities also exist in government agencies, corporate legal departments, and private law firms specializing in banking and finance law.

Fintech Compliance Officer

A Fintech Compliance Officer ensures that financial technology companies adhere to regulatory requirements and industry standards. Your expertise in banking law equips you to navigate complex legal frameworks, managing risks related to data privacy, anti-money laundering, and consumer protection. This role is critical in fostering secure innovation while maintaining trust and compliance in the rapidly evolving fintech sector.

Blockchain Legal Advisor

A Blockchain Legal Advisor specializes in navigating the complex legal landscape surrounding blockchain technology and cryptocurrencies, ensuring compliance with financial regulations and data protection laws. They provide strategic advice on smart contracts, token offerings, and digital asset management, bridging the gap between cutting-edge technology and legal frameworks. Expertise in banking law enhances their ability to address regulatory challenges, mitigate risks, and support blockchain integration in financial institutions.

Regulatory Technology (RegTech) Specialist

A Regulatory Technology (RegTech) Specialist leverages expertise in banking law to develop and implement technology solutions that ensure compliance with financial regulations. This role involves analyzing regulatory requirements, designing software tools for risk management, and streamlining compliance processes to reduce operational costs and enhance accuracy. Professionals in this field bridge the gap between legal frameworks and innovative technology to support banks in navigating complex regulatory landscapes efficiently.

Anti-Money Laundering (AML) Analyst

An Anti-Money Laundering (AML) Analyst monitors and investigates suspicious financial activities to ensure compliance with banking regulations and prevent illegal money laundering. They analyze transaction data, conduct customer due diligence, and prepare detailed reports for regulatory authorities. Proficiency in financial laws, data analysis, and risk assessment is essential for this role within banking institutions.

Digital Banking Legal Counsel

A Digital Banking Legal Counsel specializes in navigating the complex regulatory landscape of online financial services, ensuring compliance with evolving digital banking laws. Your role involves advising fintech startups, banks, and payment providers on contract negotiation, data privacy, and cybersecurity regulations. This expertise is crucial for mitigating legal risks and fostering innovation in the rapidly changing digital finance sector.

Data Privacy Officer (Banking Sector)

A Data Privacy Officer in the banking sector ensures compliance with data protection regulations while safeguarding sensitive customer information. You will implement privacy policies, monitor data handling practices, and manage risks related to personal data within financial institutions. This role combines expertise in banking law with a strong understanding of data privacy frameworks to protect both the bank and its clients.

Sustainable Finance Legal Advisor

A Sustainable Finance Legal Advisor specializes in navigating the complex regulations and policies that govern green investments and ethical financial practices. This role involves advising banks and financial institutions on compliance with environmental, social, and governance (ESG) standards to promote sustainable economic growth. Expertise in banking law combined with sustainability principles enables these advisors to structure financial products that support renewable energy projects and socially responsible initiatives.

Cryptocurrency Regulatory Specialist

A banking law degree equips you with the expertise to navigate complex legal frameworks governing digital currencies, making a Cryptocurrency Regulatory Specialist role ideal. This position involves analyzing and ensuring compliance with evolving regulations in the cryptocurrency market to protect financial institutions and investors. Your skills help bridge the gap between innovative blockchain technology and traditional banking regulations.

Banking Innovation Policy Analyst

A Banking Innovation Policy Analyst evaluates emerging financial technologies and regulatory frameworks to ensure compliance and promote market growth. You play a critical role in shaping policies that balance innovation with risk management in the banking sector. This position requires expertise in banking law, technology trends, and regulatory impact assessment.

Good to know: jobs for banking law degree

Overview of Banking Law Careers in the Financial Sector

Banking law careers in the financial sector encompass roles such as compliance officers, regulatory advisors, and corporate counsel specializing in finance. Professionals in this field ensure banks and financial institutions adhere to laws governing transactions, lending, and securities. Your expertise can guide organizations through complex legal frameworks and mitigate risk in the banking industry.

Key Roles for Banking Law Graduates in Financial Institutions

A banking law degree opens doors to numerous specialized roles within financial institutions. Graduates play a crucial role in ensuring regulatory compliance and managing legal risks in the banking sector.

- Compliance Officer - Oversees adherence to banking regulations and internal policies to prevent legal violations.

- Risk Management Analyst - Evaluates legal risks related to lending, investments, and financial products to safeguard the institution.

- Legal Counsel - Provides expert advice on contracts, mergers, acquisitions, and dispute resolution within banking operations.

Regulatory Compliance and Risk Management Positions

A banking law degree opens doors to a variety of roles in Regulatory Compliance and Risk Management within the financial sector. Professionals in these positions ensure that banks adhere to legal standards and manage potential risks effectively.

Compliance officers monitor regulatory changes and implement policies to prevent violations of banking laws. Risk managers analyze financial risks and develop strategies to mitigate them, safeguarding the institution's stability.

Emerging Opportunities in Financial Technology (FinTech)

A banking law degree opens diverse career paths within the financial sector, especially in the rapidly evolving field of Financial Technology (FinTech). Expertise in regulatory compliance, digital payments, and blockchain technology is increasingly sought after.

Emerging opportunities include roles such as FinTech compliance officer, who ensures adherence to evolving financial regulations and anti-money laundering laws. Legal advisors specializing in smart contracts help structure agreements that are enforceable in decentralized platforms. Moreover, careers in regulatory technology (RegTech) focus on leveraging software to assist financial institutions in meeting legal requirements efficiently.

Skills and Qualifications Required for Banking Law Careers

What skills and qualifications are essential for careers in banking law? Banking law professionals must possess a strong understanding of financial regulations, compliance standards, and contract law. Critical skills include analytical thinking, attention to detail, and effective communication to navigate complex legal and financial environments.

Which qualifications enhance job prospects in banking law? A degree in law with specialization in banking or finance law is fundamental. Professional certifications such as Certified Regulatory Compliance Manager (CRCM) or courses in anti-money laundering (AML) also improve career opportunities.

How important is experience for roles in banking law? Practical experience through internships or legal clerkships in banking institutions is highly valued. Experience in risk assessment, regulatory reporting, and dispute resolution strengthens a candidate's profile.

What technical skills support a career in banking law? Proficiency in legal research databases, financial software, and document management systems is important. Understanding international banking regulations and digital banking compliance further differentiates professionals.

Which personal attributes contribute to success in banking law careers? Strong ethical judgment, problem-solving abilities, and resilience under pressure are crucial traits. Collaboration skills and the ability to interpret complex legal texts increase effectiveness in this sector.

Career Advancement and Professional Development Paths

A banking law degree opens diverse career opportunities in finance, compliance, and legal advisory roles. Professionals can advance by specializing in regulatory frameworks, gaining certifications, and developing leadership skills.

- Compliance Officer - Ensures financial institutions adhere to laws and regulations to avoid legal risks.

- Legal Advisor - Provides expert counsel on banking regulations and contract negotiations.

- Risk Manager - Identifies and mitigates potential legal and financial risks within banking operations.

Strategic professional development through certifications and practical experience accelerates career advancement in banking law.

Job Market Trends for Banking Law Graduates

Graduates with a banking law degree are increasingly sought after in financial regulatory bodies and compliance departments. The demand reflects growing complexities in banking regulations and the emphasis on risk management.

- Regulatory Compliance Specialists - These professionals ensure banks adhere to evolving financial laws and anti-money laundering regulations.

- Legal Advisors for Financial Institutions - They provide counsel on contracts, mergers, and dispute resolution within banking sectors.

- Risk Management Consultants - They assess legal risks in banking operations, helping institutions mitigate potential liabilities.

jobsintra.com

jobsintra.com