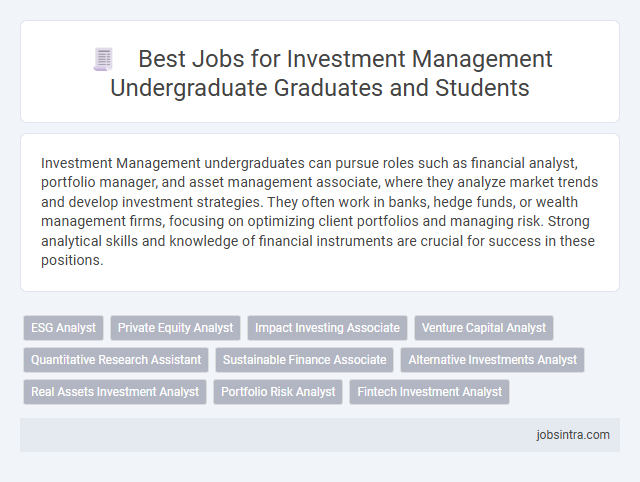

Investment Management undergraduates can pursue roles such as financial analyst, portfolio manager, and asset management associate, where they analyze market trends and develop investment strategies. They often work in banks, hedge funds, or wealth management firms, focusing on optimizing client portfolios and managing risk. Strong analytical skills and knowledge of financial instruments are crucial for success in these positions.

ESG Analyst

An ESG Analyst evaluates environmental, social, and governance factors to help investment firms integrate sustainable practices into their portfolios. This role involves analyzing company data, industry trends, and regulatory changes to assess risks and opportunities related to ESG criteria. Your expertise supports responsible investing decisions that align financial performance with ethical standards.

Private Equity Analyst

A Private Equity Analyst evaluates investment opportunities by conducting in-depth financial analysis, market research, and due diligence on potential targets. You will collaborate with senior team members to assess company performance, model financial projections, and support transaction execution. This role is ideal for those with strong analytical skills and a passion for driving business growth through strategic investments.

Impact Investing Associate

Impact Investing Associates play a crucial role in identifying and analyzing investment opportunities that generate positive social and environmental outcomes alongside financial returns. They conduct rigorous due diligence, monitor portfolio performance, and collaborate with stakeholders to ensure investments align with sustainable and ethical criteria. This position demands strong analytical skills, a deep understanding of ESG factors, and a passion for driving measurable impact in the financial sector.

Venture Capital Analyst

Venture Capital Analysts conduct market research, evaluate startup companies, and analyze financial data to identify promising investment opportunities. You will support decision-making by assessing business models, growth potential, and industry trends, providing critical insights to portfolio managers. Strong analytical skills and a keen understanding of venture ecosystems are essential for success in this dynamic role.

Quantitative Research Assistant

Quantitative Research Assistants in investment management analyze financial data using advanced mathematical models to support portfolio strategies and risk management. They apply statistical techniques and programming skills to develop predictive tools that enhance investment decisions. Their work bridges quantitative analysis and market insights, aiding asset managers in optimizing returns.

Sustainable Finance Associate

A Sustainable Finance Associate plays a critical role in integrating environmental, social, and governance (ESG) criteria into investment decisions, helping firms achieve sustainable growth and ethical impact. You analyze financial data and assess the sustainability performance of companies to guide responsible investment strategies. This position suits Investment Management graduates passionate about driving positive change through finance.

Alternative Investments Analyst

An Alternative Investments Analyst evaluates non-traditional assets such as hedge funds, private equity, and real estate to diversify investment portfolios and enhance returns. You will analyze market trends, due diligence reports, and financial statements to assess risk and identify profitable opportunities. This role requires strong analytical skills and a deep understanding of alternative asset classes within investment management.

Real Assets Investment Analyst

Real Assets Investment Analysts specialize in evaluating and managing physical assets such as real estate, infrastructure, and commodities to maximize portfolio returns. You will analyze market trends, perform financial modeling, and assess risk factors to provide strategic investment recommendations. This role requires strong analytical skills and a deep understanding of both financial markets and tangible asset valuation.

Portfolio Risk Analyst

Portfolio Risk Analysts in investment management evaluate potential risks within investment portfolios by analyzing market trends, asset correlations, and economic indicators to minimize financial losses. They utilize quantitative models and software tools to identify exposure to various risk factors, ensuring alignment with clients' risk tolerance and regulatory requirements. Strong analytical skills and proficiency in data analysis are essential for success in managing portfolio risks effectively.

Good to know: jobs for Investment Management undergraduate

Introduction to Investment Management as a Career Path

Investment management offers diverse career opportunities for undergraduates seeking to build expertise in financial markets and asset allocation. This field combines analytical skills with strategic decision-making to optimize investment portfolios and manage client wealth.

- Portfolio Manager - Oversees investment portfolios by selecting assets and adjusting allocations to meet financial goals and risk tolerance.

- Financial Analyst - Conducts research and evaluates financial data to provide insights for investment strategies and recommendations.

- Risk Manager - Identifies and mitigates financial risks within investment portfolios to protect assets and enhance returns.

Key Skills Required in Investment Management

Investment management undergraduates are well-suited for roles such as portfolio analyst, financial advisor, and risk manager within financial institutions or asset management firms. These positions require a strong understanding of market trends, asset allocation, and financial instruments.

Key skills essential for success include analytical thinking, quantitative analysis, and proficiency in financial modeling software. Effective communication and decision-making abilities are critical for advising clients and managing investment portfolios.

Top Entry-Level Roles for Investment Management Graduates

Investment Management graduates have access to top entry-level roles such as Financial Analyst, Portfolio Analyst, and Investment Associate. These positions involve analyzing market trends, managing client portfolios, and supporting senior investment managers in decision-making. Your strong analytical skills and understanding of financial markets make you a valuable asset in these competitive roles.

High-Growth Career Tracks within Investment Management

Investment Management undergraduates are well-positioned for careers in dynamic sectors driving financial growth and innovation. High-growth career tracks within this field combine analytical expertise and market insight with expanding global investment opportunities.

- Equity Research Analyst - Specialists who analyze stock trends and financial data to guide investment decisions in rapidly evolving markets.

- Portfolio Manager - Professionals managing diverse investment portfolios focused on maximizing returns in emerging industries and sectors.

- Risk Management Specialist - Experts developing strategies to minimize financial risk and ensure compliance amid increasing market volatility.

Essential Certifications and Qualifications

| Job Role | Essential Certifications | Key Qualifications |

|---|---|---|

| Financial Analyst |

|

|

| Portfolio Manager |

|

|

| Investment Banking Analyst |

|

|

| Risk Analyst |

|

|

| Investment Consultant |

|

|

Leading Employers in the Investment Management Sector

Graduates with an undergraduate degree in Investment Management have a wide range of career opportunities in the financial sector. Leading employers in this field include top asset management firms, global banks, and specialized investment advisory companies.

Top firms such as BlackRock, Vanguard, and JP Morgan Chase are known for hiring Investment Management graduates for roles in portfolio management, financial analysis, and risk assessment. These companies offer structured graduate programs designed to develop expertise in asset allocation and investment strategies. Your skills in market analysis and financial modeling are highly sought after by these industry leaders.

Tips for Landing Your First Investment Management Job

What are effective strategies for landing your first investment management job? Developing strong financial modeling skills and obtaining relevant internships increase your employability significantly. Networking with professionals and joining industry groups can also open doors in this competitive field.

How important is educational background for investment management roles? A degree in finance, economics, or commerce provides a solid knowledge base essential for understanding market dynamics. Pursuing certifications like the CFA charter enhances credibility and career prospects.

What practical experience should candidates highlight when applying? Internships with asset management firms or financial institutions demonstrate hands-on understanding of portfolio management. Showcasing projects involving equity research or risk assessment adds valuable proof of applied skills.

How can candidates build a strong professional network in investment management? Attending industry conferences and participating in finance workshops connect you with mentors and hiring managers. Engaging on platforms like LinkedIn helps maintain relationships and stay updated on job openings.

Why is staying informed about market trends crucial when entering investment management? Awareness of economic changes and investment vehicles enables better decision-making and interview performance. Following financial news and subscribing to relevant publications show genuine industry interest to employers.

jobsintra.com

jobsintra.com