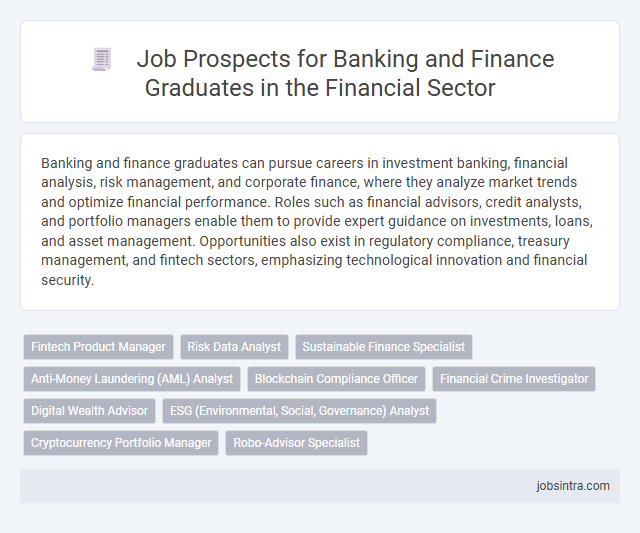

Banking and finance graduates can pursue careers in investment banking, financial analysis, risk management, and corporate finance, where they analyze market trends and optimize financial performance. Roles such as financial advisors, credit analysts, and portfolio managers enable them to provide expert guidance on investments, loans, and asset management. Opportunities also exist in regulatory compliance, treasury management, and fintech sectors, emphasizing technological innovation and financial security.

Fintech Product Manager

Fintech Product Managers in banking and finance drive the development and launch of innovative financial technology solutions, bridging the gap between technical teams and market needs. They analyze customer feedback and market trends to design user-centric digital products that enhance banking services and streamline financial processes. Expertise in both finance principles and agile project management is essential to successfully deliver products that meet regulatory standards and client expectations.

Risk Data Analyst

Risk Data Analysts in the banking and finance sector specialize in identifying, analyzing, and mitigating financial risks by leveraging advanced data analytics and statistical models. They interpret large datasets to detect patterns, forecast potential losses, and ensure compliance with regulatory standards, supporting informed decision-making. Their expertise is critical for maintaining the financial stability of institutions and enhancing risk management strategies.

Sustainable Finance Specialist

Sustainable Finance Specialists play a crucial role in guiding financial institutions and corporations toward environmentally responsible investment decisions. By integrating environmental, social, and governance (ESG) criteria into financial analysis, you can help drive sustainable economic growth and mitigate climate risks. This career path offers opportunities to influence policy, develop green financial products, and support ethical investment strategies.

Anti-Money Laundering (AML) Analyst

An Anti-Money Laundering (AML) Analyst plays a critical role in banking and finance by identifying suspicious transactions and ensuring compliance with regulatory requirements. Your expertise helps prevent financial crimes by analyzing transaction patterns, investigating alerts, and working closely with compliance teams to mitigate risks. This position demands strong analytical skills, attention to detail, and a thorough understanding of financial regulations and reporting standards.

Blockchain Compliance Officer

Blockchain Compliance Officers ensure that blockchain technologies and cryptocurrency transactions comply with legal and regulatory standards. They analyze financial regulations, implement risk management strategies, and develop compliance programs specific to decentralized finance models. Their expertise helps financial institutions navigate the evolving landscape of blockchain while preventing fraud and ensuring transparency.

Financial Crime Investigator

A career as a Financial Crime Investigator allows Banking and Finance graduates to utilize their analytical skills to detect and prevent fraud, money laundering, and other illicit financial activities. You will work closely with regulatory agencies and financial institutions to ensure compliance and protect assets. This role demands strong attention to detail, critical thinking, and knowledge of financial laws and regulations.

Digital Wealth Advisor

Digital wealth advisors offer personalized financial planning and investment strategies using advanced technology and data analytics, making them essential in modern banking and finance sectors. Graduates in banking and finance can leverage their expertise to analyze market trends, assess client risk profiles, and recommend tailored digital investment solutions. This role demands a strong understanding of financial markets, digital platforms, and customer relationship management to optimize client portfolios efficiently.

ESG (Environmental, Social, Governance) Analyst

Banking and Finance graduates can pursue a career as an ESG (Environmental, Social, Governance) Analyst, evaluating companies' sustainability practices and ethical impact. This role involves assessing financial risks and opportunities related to environmental policies, social responsibility, and corporate governance standards. Your expertise helps investors make informed decisions aligning with long-term sustainable growth and ethical considerations.

Cryptocurrency Portfolio Manager

A Cryptocurrency Portfolio Manager oversees digital asset investments, analyzing market trends and managing the risk associated with volatile cryptocurrencies. Your expertise in blockchain technology and finance allows you to develop strategies that optimize returns while ensuring compliance with evolving regulations. Strong analytical skills and a deep understanding of both traditional finance and crypto markets are essential in this role.

Good to know: jobs for Banking and Finance graduates

Overview of the Financial Sector

The financial sector offers diverse career opportunities for Banking and Finance graduates, including roles in investment banking, financial analysis, and risk management. You can work with banks, insurance companies, asset management firms, or financial consultancies specializing in wealth management and corporate finance. This dynamic industry demands strong analytical skills, market knowledge, and the ability to navigate regulatory frameworks to support economic growth and financial stability.

Key Career Paths for Banking and Finance Graduates

Banking and Finance graduates have diverse career opportunities across various sectors. Key career paths include roles in investment banking, financial analysis, and risk management.

Graduates can pursue careers as financial analysts, helping businesses make informed investment decisions. Careers in asset management enable professionals to manage and grow client portfolios effectively.

Core Skills Demanded by Employers

| Job Role | Core Skills Demanded by Employers | Relevant Industries |

|---|---|---|

| Financial Analyst | Financial modeling, data analysis, risk assessment, proficiency in Excel and financial software, critical thinking, strong quantitative skills | Investment banking, corporate finance, asset management, consulting |

| Credit Analyst | Credit risk evaluation, knowledge of banking regulations, analytical reasoning, decision making, communication skills | Commercial banks, credit rating agencies, consumer finance companies |

| Investment Banker | Valuation techniques, mergers and acquisitions expertise, negotiation, financial statement analysis, high-pressure problem solving | Investment banks, private equity firms, hedge funds |

| Risk Manager | Risk identification and mitigation, regulatory compliance, statistical analysis, strategic planning, attention to detail | Banking institutions, insurance, financial services firms |

| Financial Planner | Personal finance knowledge, portfolio management, client communication, taxation understanding, goal-oriented advising | Wealth management firms, insurance companies, retail banking |

| Compliance Officer | Regulatory knowledge, auditing skills, risk management, ethical judgment, report writing | Banking, financial services, regulatory bodies |

| Banking Operations Manager | Process optimization, team leadership, financial software proficiency, problem solving, operational risk management | Retail banks, commercial banks, credit unions |

| Accounts Officer | Bookkeeping, budgeting, financial reporting, attention to detail, use of accounting software | Banks, financial institutions, corporate finance departments |

Emerging Trends Shaping Job Opportunities

Banking and finance graduates are entering a rapidly evolving job market driven by technological advancements and shifting economic landscapes. Emerging trends are creating new career pathways that require a mix of analytical, technological, and strategic skills.

- Rise of FinTech Roles - Jobs related to blockchain technology, digital payments, and cryptocurrency management are expanding as financial services embrace innovation.

- Data Analytics and Financial Modeling - Increased demand for expertise in big data and AI is shaping roles in risk assessment, investment analysis, and fraud detection.

- Green Finance and Sustainable Investing - Growing emphasis on environmental, social, and governance (ESG) criteria is driving opportunities in sustainable asset management and ethical banking.

Salary Expectations and Growth Potential

Banking and Finance graduates can pursue careers such as financial analyst, investment banker, and credit analyst, each offering competitive salary packages. Entry-level positions typically start with salaries ranging from $50,000 to $70,000 annually, with potential to exceed $150,000 in senior roles. Job growth in this sector is projected at 7% over the next decade, driven by expanding financial services and technological innovation.

Challenges and Competitive Landscape

Banking and Finance graduates face a rapidly evolving job market characterized by technological disruption and stringent regulatory requirements. Navigating these challenges demands a strong grasp of financial instruments, risk management, and digital banking innovations.

The competitive landscape is intense, with employers seeking candidates who demonstrate analytical skills, adaptability, and proficiency in financial technologies such as blockchain and AI-driven analytics. Roles in investment banking, financial analysis, risk assessment, and wealth management are highly sought after but require continuous learning and certification. Your ability to differentiate yourself through specialized knowledge and practical experience will be critical for career advancement.

Tips for Enhancing Employability

Banking and Finance graduates have diverse career opportunities in sectors such as investment banking, financial analysis, and risk management. Developing specialized skills and gaining practical experience significantly boost job prospects.

- Build Technical Skills - Master financial modeling, data analysis, and proficiency in software like Excel and Bloomberg to stand out in the job market.

- Acquire Certifications - Obtain credentials like CFA, CPA, or FRM to validate expertise and increase credibility with employers.

- Network Actively - Engage with industry professionals through events and online platforms to uncover job opportunities and industry insights.

Focus on continuous learning and practical experience to enhance your employability and career growth potential.

jobsintra.com

jobsintra.com