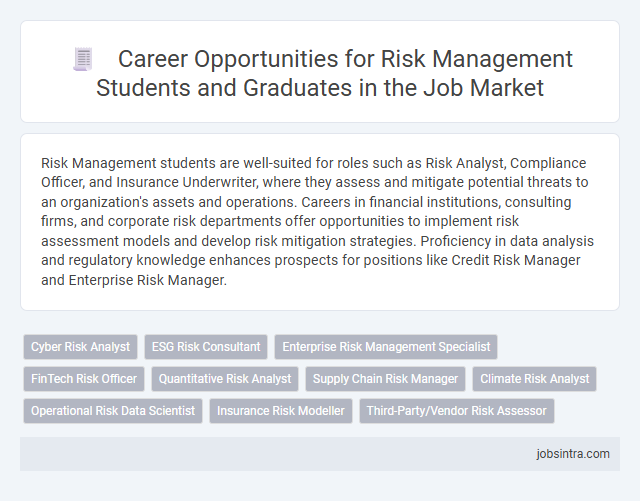

Risk Management students are well-suited for roles such as Risk Analyst, Compliance Officer, and Insurance Underwriter, where they assess and mitigate potential threats to an organization's assets and operations. Careers in financial institutions, consulting firms, and corporate risk departments offer opportunities to implement risk assessment models and develop risk mitigation strategies. Proficiency in data analysis and regulatory knowledge enhances prospects for positions like Credit Risk Manager and Enterprise Risk Manager.

Cyber Risk Analyst

Cyber Risk Analysts evaluate and mitigate potential threats to an organization's digital assets by identifying vulnerabilities in cybersecurity systems and implementing risk management strategies. They analyze data from security incidents, assess the impact of emerging cyber threats, and recommend controls to minimize exposure and ensure compliance with regulatory standards. Proficiency in risk assessment frameworks, threat analysis tools, and incident response protocols is essential for effectively managing cyber risks in dynamic environments.

ESG Risk Consultant

ESG Risk Consultants evaluate environmental, social, and governance factors to help organizations identify and mitigate risks that could impact financial performance and reputation. Your expertise in risk management equips you to analyze sustainability practices, assess regulatory compliance, and advise on strategies that integrate ESG criteria into overall risk frameworks. This role bridges finance, strategy, and sustainability, making it ideal for Risk Management students aiming to influence responsible business decisions.

Enterprise Risk Management Specialist

Enterprise Risk Management Specialists analyze and mitigate risks affecting an organization's strategic goals by identifying potential threats and implementing comprehensive risk frameworks. They collaborate with cross-functional teams to develop policies that safeguard assets, ensure regulatory compliance, and enhance overall operational resilience. Proficiency in data analysis, risk assessment tools, and industry regulations is essential for success in this role.

FinTech Risk Officer

A FinTech Risk Officer plays a vital role in identifying and mitigating financial risks within innovative technology-driven companies. This position requires strong analytical skills to evaluate potential threats from cyber security breaches, regulatory compliance, and market volatility. Your expertise in risk management positions you to safeguard FinTech firms against operational losses and ensure business resilience.

Quantitative Risk Analyst

Quantitative Risk Analysts use advanced mathematical models and statistical techniques to assess and mitigate financial risks. Your skills in data analysis and probability help businesses identify potential losses and develop strategies to protect assets. This role is essential in industries like banking, insurance, and investment firms where precision in risk assessment drives critical decision-making.

Supply Chain Risk Manager

A Supply Chain Risk Manager analyzes and mitigates risks that could disrupt the supply chain, ensuring business continuity and minimizing financial losses. This role involves assessing vulnerabilities, developing contingency plans, and collaborating with suppliers and internal teams to manage risks effectively. Strong analytical skills and knowledge of logistics, compliance, and risk assessment are essential for success in this position.

Climate Risk Analyst

Climate Risk Analysts assess and quantify potential environmental threats that impact businesses and financial institutions, ensuring sustainable decision-making. Your expertise in analyzing climate-related data supports companies in mitigating risks associated with regulatory changes, natural disasters, and shifting market dynamics. This role is essential for firms aiming to integrate environmental, social, and governance (ESG) factors into their risk management strategies.

Operational Risk Data Scientist

Operational Risk Data Scientists analyze complex data sets to identify, assess, and mitigate potential risks within business operations. They develop predictive models and algorithms to improve risk detection and decision-making processes, enhancing overall organizational resilience. Their expertise in statistical analysis and risk management enables companies to minimize financial losses and ensure regulatory compliance.

Insurance Risk Modeller

Insurance Risk Modellers analyze data and assess potential financial risks to help insurance companies develop policies and pricing strategies that minimize losses. Your expertise in statistical modeling and risk assessment enables you to predict claim likelihoods and create effective risk mitigation plans. This role is essential for optimizing insurance portfolios and ensuring company profitability.

Good to know: jobs for Risk Management students

Overview of the Risk Management Field

Risk management is a critical field in business focused on identifying, analyzing, and mitigating potential threats to an organization's assets and earnings. Students specializing in risk management develop skills to assess financial, operational, and strategic risks.

Careers for risk management graduates include roles such as risk analyst, compliance officer, insurance underwriter, and loss prevention specialist. These positions are essential in industries like banking, insurance, healthcare, and corporate governance, where managing uncertainty and safeguarding resources is vital.

Key Industries Hiring Risk Management Graduates

Risk Management graduates have diverse career opportunities across several key industries. These sectors value skills in identifying, analyzing, and mitigating risks to protect assets and ensure regulatory compliance.

- Financial Services - Banks, investment firms, and insurance companies hire risk management professionals to assess credit, market, and operational risks.

- Healthcare - Hospitals and healthcare providers employ risk managers to reduce patient safety risks and ensure compliance with healthcare regulations.

- Energy and Utilities - Companies in oil, gas, and renewable energy sectors recruit risk analysts to manage environmental, safety, and operational risks.

In-Demand Roles for Risk Management Professionals

Risk management students are increasingly sought after in various industries, including finance, insurance, and corporate sectors. Roles such as Risk Analyst, Compliance Officer, and Credit Risk Manager are among the top in-demand positions.

These roles require expertise in identifying, assessing, and mitigating potential risks that could impact business operations. Your skills in data analysis, regulatory knowledge, and strategic planning make you a valuable asset in maintaining organizational resilience.

Essential Skills for Career Success in Risk Management

What are the primary job opportunities available for Risk Management students? Careers in risk assessment, compliance analysis, and financial risk management are highly sought after. These roles require a deep understanding of risk identification and mitigation strategies.

Which essential skills ensure career success in Risk Management? Strong analytical abilities and proficiency in data interpretation are critical for evaluating potential risks. Effective communication skills are necessary to convey risk factors to stakeholders clearly.

How important is knowledge of regulatory frameworks for Risk Management professionals? Expertise in regulations like SOX, Basel III, and GDPR is vital for ensuring compliance and reducing legal risks. Staying updated on changing laws helps prevent costly penalties and enhances organizational resilience.

Why is proficiency in financial modeling important for Risk Management careers? Financial modeling assists in predicting potential losses and assessing risk exposure under various scenarios. Mastery of Excel and specialized software supports accurate risk quantification and decision-making.

What role does problem-solving play in a Risk Management professional's job? Identifying, analyzing, and prioritizing risks requires critical thinking and innovative solutions. Practical problem-solving skills aid in developing effective risk mitigation plans that align with business objectives.

Emerging Trends Shaping Risk Management Careers

Risk management students are increasingly pursuing careers in cyber risk analysis, data privacy compliance, and environmental risk assessment. Emerging trends highlight the integration of artificial intelligence and machine learning to identify and mitigate complex risks faster and more accurately. Your expertise in these areas positions you for roles in fintech, healthcare, and global supply chain risk management.

Professional Certifications and Advancement Opportunities

Risk Management students can pursue roles such as Risk Analyst, Compliance Officer, and Insurance Underwriter, which require a strong understanding of financial and operational risks. Professional certifications like Certified Risk Manager (CRM), Financial Risk Manager (FRM), and Project Management Professional (PMP) enhance career prospects by validating expertise and improving job marketability. Advancement opportunities include senior risk manager, chief risk officer, and roles in strategic risk consulting, often supported by continuous professional development and industry experience.

Strategies for Job Searching and Networking in Risk Management

Risk Management students have diverse career options in financial services, insurance, corporate risk departments, and consultancy firms. Effective strategies for job searching and networking enhance access to these opportunities and support career growth.

- Leverage Professional Associations - Join organizations like the Risk Management Society (RIMS) to connect with industry professionals and gain access to exclusive job listings.

- Utilize Internship Programs - Participate in internships at banks, insurance companies, or risk consulting firms to gain hands-on experience and build a professional network.

- Engage in Online Networking Platforms - Create a LinkedIn profile focused on risk management skills and connect with recruiters and industry experts to discover job openings.

jobsintra.com

jobsintra.com