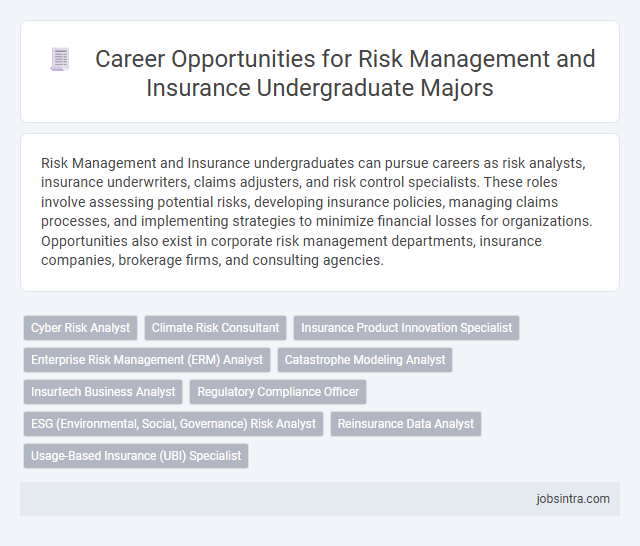

Risk Management and Insurance undergraduates can pursue careers as risk analysts, insurance underwriters, claims adjusters, and risk control specialists. These roles involve assessing potential risks, developing insurance policies, managing claims processes, and implementing strategies to minimize financial losses for organizations. Opportunities also exist in corporate risk management departments, insurance companies, brokerage firms, and consulting agencies.

Cyber Risk Analyst

Cyber Risk Analysts specialize in identifying and mitigating digital threats to protect organizations from cyberattacks and data breaches. They analyze security vulnerabilities, assess potential risks, and implement strategies to enhance cybersecurity defenses. Your skills in Risk Management and Insurance equip you to evaluate and manage financial impacts of cyber incidents effectively.

Climate Risk Consultant

Climate Risk Consultants analyze environmental data to help businesses identify, assess, and mitigate risks associated with climate change. You can leverage your Risk Management and Insurance background to develop strategies that reduce financial exposure to natural disasters, regulatory changes, and shifting market conditions. This role often involves collaborating with insurers, policymakers, and corporate stakeholders to enhance resilience and sustainability.

Insurance Product Innovation Specialist

Insurance Product Innovation Specialists develop and enhance insurance products by analyzing market trends, customer needs, and emerging risks. They collaborate with underwriting, actuarial, and marketing teams to design innovative coverage solutions that address evolving risk landscapes. Expertise in Risk Management and Insurance equips graduates to identify gaps and create competitive products that drive business growth.

Enterprise Risk Management (ERM) Analyst

Enterprise Risk Management (ERM) Analysts identify, assess, and mitigate risks that could impact an organization's strategic goals. You will analyze data, develop risk models, and collaborate with various departments to create comprehensive risk management strategies. This role demands strong analytical skills and knowledge of financial, operational, and compliance risks within diverse industries.

Catastrophe Modeling Analyst

A Catastrophe Modeling Analyst evaluates the financial impact of natural disasters using advanced statistical models and risk assessment tools. They analyze data on hurricanes, earthquakes, floods, and other catastrophic events to help insurance companies forecast potential losses and set appropriate premiums. Expertise in data analytics, coding, and geographic information systems (GIS) is essential for success in this role.

Insurtech Business Analyst

An Insurtech Business Analyst bridges the gap between traditional insurance practices and innovative technology solutions, driving digital transformation within the industry. Your role involves analyzing market trends, customer data, and emerging technologies to optimize risk assessment and insurance product offerings. Strong skills in data analytics, problem-solving, and understanding of insurance regulations make this position critical for advancing insurtech initiatives.

Regulatory Compliance Officer

Regulatory Compliance Officers in Risk Management and Insurance ensure companies adhere to industry laws and regulations, mitigating legal risks. They conduct audits, develop compliance policies, and monitor internal processes to prevent violations and protect organizational integrity. Expertise in regulatory frameworks and risk assessment is essential for maintaining corporate governance in this role.

ESG (Environmental, Social, Governance) Risk Analyst

Risk Management and Insurance undergraduates can pursue careers as ESG Risk Analysts, where they evaluate environmental, social, and governance factors to identify potential risks and opportunities for companies. You will analyze data to ensure that businesses comply with ESG standards and develop strategies to mitigate associated risks. This role bridges traditional risk management with sustainability initiatives, making it crucial for companies aiming to achieve long-term resilience.

Reinsurance Data Analyst

A Reinsurance Data Analyst interprets complex data sets to assess risks and inform underwriting decisions within the reinsurance sector. This role requires strong analytical skills to evaluate loss trends, pricing models, and policy performance, enabling companies to optimize their risk portfolios. Proficiency in statistical software and knowledge of insurance principles enhances the accuracy of risk assessment and financial forecasting.

Good to know: jobs for Risk Management and Insurance undergraduate

Overview of Risk Management and Insurance Field

The field of Risk Management and Insurance revolves around identifying, analyzing, and mitigating potential risks that businesses face. Careers in this area combine financial acumen with strategic planning to protect assets and ensure organizational resilience.

- Risk Analyst - Evaluates financial risks and develops strategies to minimize exposure for companies and clients.

- Insurance Underwriter - Assesses insurance applications to determine coverage terms and premiums based on risk factors.

- Claims Adjuster - Investigates insurance claims to verify legitimacy and facilitate fair settlements for policyholders.

In-Demand Job Roles for Graduates

Graduates with a degree in Risk Management and Insurance have a wide range of career opportunities in the business sector. These roles focus on identifying, assessing, and mitigating financial and operational risks.

- Risk Analyst - Evaluates potential risks to minimize financial losses and supports strategic decision-making.

- Insurance Underwriter - Assesses insurance applications and determines coverage terms and pricing.

- Claims Adjuster - Investigates insurance claims to determine liability and settlement amounts.

These in-demand roles leverage analytical skills and industry knowledge, offering strong career growth for graduates.

Key Skills and Competencies Employers Seek

Risk Management and Insurance undergraduates are sought after for roles such as Risk Analyst, Insurance Underwriter, and Compliance Officer. Employers prioritize key skills including analytical thinking, attention to detail, and strong communication abilities. Competencies in data analysis, regulatory knowledge, and problem-solving enhance a candidate's capacity to identify and mitigate potential risks effectively.

Career Pathways in Risk Management

A Risk Management and Insurance undergraduate degree opens diverse career pathways in managing organizational risks. Your expertise equips you to protect assets, ensure compliance, and optimize insurance strategies.

- Risk Analyst - Evaluates potential risks to minimize financial losses for businesses through data analysis and forecasting.

- Insurance Underwriter - Assesses insurance applications to determine risk exposure and appropriate policy terms.

- Claims Adjuster - Investigates insurance claims to ensure fair and accurate compensation for policyholders.

Industry Sectors Hiring RMI Majors

Risk Management and Insurance (RMI) undergraduates possess specialized skills that align with various industry sectors such as finance, healthcare, and manufacturing. Employers in these sectors value their ability to identify, assess, and mitigate risks to safeguard assets and ensure regulatory compliance.

The finance sector, including banks and investment firms, frequently hires RMI graduates to manage credit, market, and operational risks. Healthcare organizations seek RMI professionals to navigate liability, property, and employee safety risks effectively.

Professional Certifications and Advancement

Risk Management and Insurance undergraduates have numerous career opportunities in insurance companies, corporate risk departments, and consulting firms. Professional certifications enhance expertise and improve job prospects in these fields.

Certifications like the Chartered Property Casualty Underwriter (CPCU) and Associate in Risk Management (ARM) are highly valued by employers. Obtaining credentials from organizations such as The Institutes or the Risk Management Society (RIMS) boosts credibility and advancement potential. Continuous education and networking help graduates stay competitive in dynamic risk-related roles.

Emerging Trends Impacting Career Opportunities

What emerging trends are shaping career opportunities for Risk Management and Insurance undergraduates?

Technological advancements like artificial intelligence and big data analytics are transforming risk assessment and insurance underwriting processes. These innovations open new roles requiring analytical skills and technological proficiency.

How is the increasing emphasis on sustainability influencing job prospects in Risk Management and Insurance?

Growing environmental concerns and regulatory changes highlight the need for professionals skilled in managing climate risks and sustainability-related insurance products. Careers now often focus on integrating ESG factors into risk strategies.

What impact does cyber risk have on the demand for Risk Management and Insurance graduates?

Rising cyber threats create a surge in demand for specialists who understand cyber insurance and risk mitigation techniques. Your expertise in cyber risk can lead to roles in underwriting, risk assessment, and claims management.

How are global economic uncertainties affecting career paths in Risk Management and Insurance?

Volatile markets and geopolitical tensions require risk managers to develop adaptive strategies and scenario planning skills. Job opportunities are expanding in consulting firms, financial institutions, and multinational corporations.

Why is there a growing need for professionals in regulatory compliance within Risk Management and Insurance?

Complex regulatory environments increase the importance of ensuring organizational compliance with evolving laws. Graduates can pursue careers as compliance officers or risk auditors specializing in insurance sectors.

jobsintra.com

jobsintra.com