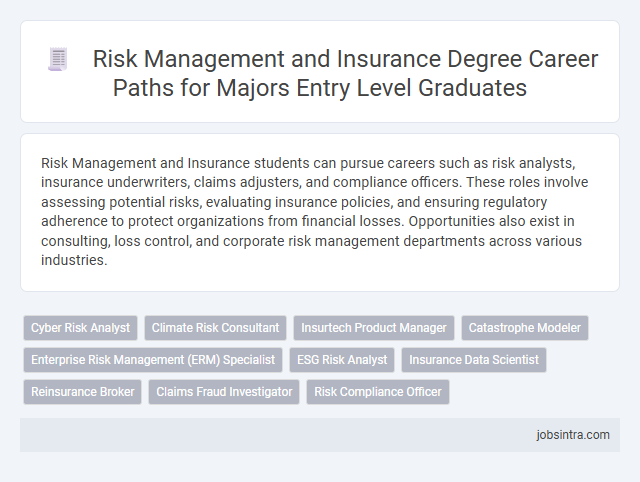

Risk Management and Insurance students can pursue careers such as risk analysts, insurance underwriters, claims adjusters, and compliance officers. These roles involve assessing potential risks, evaluating insurance policies, and ensuring regulatory adherence to protect organizations from financial losses. Opportunities also exist in consulting, loss control, and corporate risk management departments across various industries.

Cyber Risk Analyst

Cyber Risk Analysts play a critical role in identifying and mitigating potential threats to an organization's digital assets and information systems. They analyze cyber risk exposures, assess vulnerabilities, and develop strategies to protect against data breaches, ransomware attacks, and other cyber threats. Expertise in risk management principles and cybersecurity frameworks enables these professionals to design effective insurance solutions and support organizational resilience.

Climate Risk Consultant

Climate Risk Consultants analyze the impact of climate change on businesses and assets, helping organizations develop strategies to mitigate environmental risks. They assess vulnerabilities in insurance portfolios and advise on pricing models that reflect changing weather patterns. Their expertise supports risk management by integrating climate data into decision-making processes and promoting sustainability initiatives.

Insurtech Product Manager

Insurtech Product Manager roles offer Risk Management and Insurance students the opportunity to lead the development and innovation of digital insurance products. You will combine industry knowledge with technology to design user-centric solutions that enhance risk assessment and customer experience. This position requires strong analytical skills and an understanding of both insurance principles and emerging technologies.

Catastrophe Modeler

Catastrophe Modelers analyze and simulate the impact of natural and man-made disasters to assess risk exposure for insurance companies and risk management firms. They use advanced statistical models and geospatial data to predict potential financial losses, helping organizations develop effective mitigation strategies. Proficiency in data analysis, programming, and a strong understanding of climate science and engineering principles are essential for this role.

Enterprise Risk Management (ERM) Specialist

Enterprise Risk Management (ERM) Specialists analyze and mitigate risks across entire organizations, ensuring strategic goals are met while minimizing potential losses. You will utilize skills in risk assessment, compliance, and financial analysis to develop comprehensive risk management frameworks. Career opportunities include roles in corporations, consulting firms, and financial institutions focused on identifying and managing operational, financial, and strategic risks.

ESG Risk Analyst

ESG Risk Analysts evaluate environmental, social, and governance risks to support sustainable business practices and regulatory compliance. They analyze data to identify potential risks related to climate change, social impact, and corporate governance, helping companies mitigate financial and reputational damage. Expertise in risk management and insurance principles equips these professionals to recommend strategies that align with ESG goals and improve long-term resilience.

Insurance Data Scientist

Insurance Data Scientists analyze large datasets to identify patterns and predict risks, helping companies optimize underwriting and claims processes. They develop machine learning models to improve fraud detection and pricing accuracy, enhancing profitability and customer satisfaction. Proficiency in statistical tools, programming languages like Python or R, and a deep understanding of insurance principles is essential for success in this role.

Reinsurance Broker

Reinsurance brokers act as intermediaries between insurance companies and reinsurers, helping to negotiate and secure reinsurance contracts that spread risk and protect insurers from significant losses. They analyze complex risk portfolios, evaluate market conditions, and create tailored reinsurance solutions to meet client needs. This role demands strong analytical skills, deep knowledge of insurance markets, and expertise in risk assessment and contract negotiation.

Claims Fraud Investigator

A Claims Fraud Investigator plays a crucial role in identifying and preventing fraudulent insurance claims, protecting companies from financial losses. You will use analytical skills and investigative techniques to examine suspicious claims, gather evidence, and collaborate with law enforcement when necessary. This career offers opportunities in insurance firms, government agencies, and private investigation agencies, making it a valuable path for Risk Management and Insurance students.

Good to know: jobs for Risk Management and Insurance students

Overview of Risk Management and Insurance Degrees

What career opportunities are available for students with a Risk Management and Insurance degree? Graduates can pursue roles such as risk analyst, insurance underwriter, and claims adjuster. These positions involve identifying potential risks, evaluating insurance policies, and managing claims to minimize financial loss.

Core Skills Gained from Risk Management Programs

Risk Management and Insurance students acquire critical analytical skills to identify, assess, and mitigate potential risks within organizations. Core skills gained include proficiency in risk assessment techniques, knowledge of insurance policies, and expertise in regulatory compliance. These competencies prepare graduates for careers in risk analysis, insurance underwriting, claims management, and corporate risk consulting.

Entry-Level Career Paths for Graduates

Risk Management and Insurance graduates have diverse entry-level career options in industries focusing on safety, compliance, and financial protection. Your skills make you ideal for roles assessing risks and managing insurance policies efficiently.

- Risk Analyst - Analyze potential risks affecting an organization and recommend mitigation strategies.

- Insurance Underwriter - Evaluate insurance applications to determine coverage terms and pricing.

- Claims Adjuster - Investigate insurance claims and negotiate settlements to ensure fair resolutions.

Top Employers Hiring Risk Management Majors

Risk Management and Insurance students are highly sought after by leading companies across various industries. Your skills in assessing and mitigating risks position you for roles in finance, healthcare, and corporate sectors.

Top employers hiring Risk Management majors include Allianz, AIG, and Marsh & McLennan Companies. These firms offer opportunities in underwriting, claims analysis, and risk consulting, providing a strong foundation for your career growth.

Professional Certifications and Growth Opportunities

Risk Management and Insurance students have access to a wide range of job opportunities in finance, corporate risk departments, and insurance companies. Professional certifications significantly enhance career growth and open doors to specialized roles in the industry.

- Certified Risk Manager (CRM) - Validates expertise in identifying, analyzing, and managing risks across various sectors.

- Chartered Property Casualty Underwriter (CPCU) - Recognized certification that deepens knowledge in property-casualty insurance and risk management.

- Growth Opportunities - Career paths include risk analyst, insurance underwriter, claims adjuster, and chief risk officer positions.

Your commitment to obtaining professional certifications directly influences job prospects and long-term advancement in the risk management and insurance fields.

Industry Trends Impacting Career Prospects

Risk Management and Insurance students are increasingly sought after in sectors such as finance, healthcare, and technology due to evolving regulatory landscapes and emerging risks. Career prospects in these fields are shaped by advancements in data analytics, cyber risk assessment, and compliance management.

The insurance industry is adopting artificial intelligence and predictive modeling to enhance risk evaluation and fraud detection, creating demand for professionals skilled in these technologies. Climate change and global disruptions are driving growth in specialized risk management roles focused on environmental and operational risks. Graduates with expertise in cyber insurance and enterprise risk management are positioned for strong career opportunities as companies prioritize digital security and resilience.

Tips for Job Search and Networking

Risk Management and Insurance students have diverse career opportunities in fields such as underwriting, claims adjustment, and risk analysis. Effective job search strategies and networking can significantly enhance their chances of landing desirable roles.

- Leverage Industry-Specific Job Boards - Use websites like RiskJobs.com and InsuranceJobs.com to find targeted openings in risk management and insurance sectors.

- Attend Professional Association Events - Join organizations such as the Risk Management Society (RIMS) to network with industry professionals and learn about job opportunities.

- Utilize LinkedIn Effectively - Optimize your profile with relevant keywords and connect with recruiters, hiring managers, and alumni in the insurance and risk management fields.

jobsintra.com

jobsintra.com