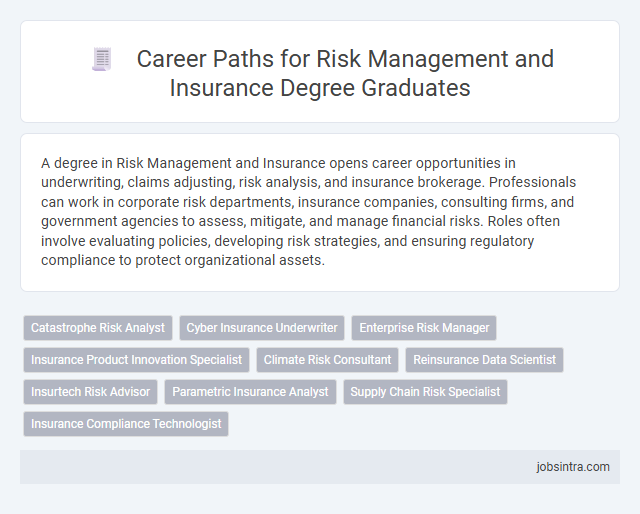

A degree in Risk Management and Insurance opens career opportunities in underwriting, claims adjusting, risk analysis, and insurance brokerage. Professionals can work in corporate risk departments, insurance companies, consulting firms, and government agencies to assess, mitigate, and manage financial risks. Roles often involve evaluating policies, developing risk strategies, and ensuring regulatory compliance to protect organizational assets.

Catastrophe Risk Analyst

A Catastrophe Risk Analyst evaluates and models potential losses from natural disasters to help organizations manage and mitigate financial exposure. This role involves analyzing data, using specialized software, and collaborating with underwriters and actuaries to develop risk assessment strategies. Your expertise in risk management and insurance equips you to provide critical insights that inform disaster preparedness and insurance underwriting decisions.

Cyber Insurance Underwriter

Cyber Insurance Underwriters assess and analyze risks related to cyber threats, data breaches, and digital liabilities to develop tailored insurance policies. They evaluate clients' cybersecurity measures and potential exposure, using advanced risk modeling to determine coverage terms and premiums. This role requires a strong understanding of cyber risk, insurance principles, and regulatory compliance within the evolving technology landscape.

Enterprise Risk Manager

An Enterprise Risk Manager identifies, assesses, and mitigates potential risks that could impact a company's operations, reputation, and financial stability. They develop comprehensive risk management strategies and policies to prevent losses and ensure regulatory compliance. This role requires strong analytical skills, knowledge of insurance products, and expertise in regulatory standards.

Insurance Product Innovation Specialist

Insurance Product Innovation Specialists develop and enhance insurance products by analyzing market trends and customer needs to create competitive offerings. They collaborate with underwriting, marketing, and actuarial teams to design innovative solutions that address emerging risks. Their expertise drives business growth by ensuring insurance products remain relevant, profitable, and aligned with regulatory requirements.

Climate Risk Consultant

A Climate Risk Consultant assesses environmental risks and develops strategies to mitigate the financial impacts of climate change on businesses and communities. Your expertise in risk management and insurance enables you to analyze climate-related data, identify vulnerabilities, and advise organizations on adaptive measures and insurance solutions. This role is vital for companies aiming to enhance resilience and comply with evolving climate regulations.

Reinsurance Data Scientist

A Risk Management and Insurance degree equips you with the analytical skills necessary to excel as a Reinsurance Data Scientist, where interpreting complex datasets to assess and model risk exposure is essential. This role involves leveraging advanced statistical techniques and machine learning algorithms to optimize reinsurance strategies and improve decision-making processes. Your expertise in risk assessment and insurance principles enhances the accuracy of predictive models, making you a valuable asset in the reinsurance industry.

Insurtech Risk Advisor

Insurtech Risk Advisors leverage technology to assess and mitigate insurance-related risks, combining expertise in risk management with advanced digital tools. They analyze data trends, develop innovative risk strategies, and collaborate with insurance companies to enhance underwriting processes. This role requires strong analytical skills and proficiency in emerging technologies to optimize risk solutions in the evolving insurance landscape.

Parametric Insurance Analyst

A Parametric Insurance Analyst specializes in designing and evaluating insurance policies that pay out based on predefined parameters or triggers, such as natural disaster measurements. You will analyze data models to assess risk exposure and help develop innovative insurance products that provide faster claims processing and financial protection. This role requires strong analytical skills and a deep understanding of risk management principles within the insurance sector.

Supply Chain Risk Specialist

A Supply Chain Risk Specialist analyzes and mitigates risks within the supply chain to ensure business continuity and minimize potential disruptions. They use advanced risk assessment tools and data analytics to identify vulnerabilities related to suppliers, logistics, and market fluctuations. This role requires strong knowledge of risk management principles and insurance strategies to develop effective contingency plans and protect organizational assets.

Good to know: jobs for Risk Management and Insurance degree

Overview of Risk Management and Insurance Careers

Risk Management and Insurance degrees open diverse career paths in business sectors focused on identifying, assessing, and mitigating financial risks. Graduates often pursue roles in insurance underwriting, claims adjusting, and risk analysis to protect organizations from potential losses.

Careers in risk management involve evaluating business risks related to finance, operations, and compliance, ensuring strategic decision-making aligns with risk tolerance. Insurance professionals work in sales, policy development, and claims management, supporting both clients and companies in managing coverage. Your expertise in this field prepares you to safeguard assets and contribute to organizational stability across industries.

Entry-Level Job Opportunities for Graduates

Graduates with a degree in Risk Management and Insurance have access to a variety of entry-level job opportunities in the business sector. You can leverage your specialized knowledge to start a promising career focused on assessing and managing potential financial risks.

- Risk Analyst - Analyze data to identify and evaluate risks that could affect an organization's assets and profitability.

- Insurance Underwriter - Assess insurance applications and determine coverage terms, premiums, and conditions.

- Claims Adjuster - Investigate insurance claims to determine the extent of the insuring company's liability.

Key Industry Sectors Hiring Risk Management Professionals

| Key Industry Sector | Relevant Job Roles | Primary Responsibilities | Skills Required |

|---|---|---|---|

| Financial Services | Risk Analyst, Underwriter, Insurance Broker | Assessing financial risks, underwriting insurance policies, managing compliance with regulatory standards | Financial modeling, regulatory knowledge, data analysis, risk assessment |

| Healthcare | Risk Manager, Compliance Officer, Insurance Coordinator | Managing healthcare liability risks, ensuring regulatory compliance, handling insurance claims | Healthcare regulations, risk mitigation, claims processing, legal knowledge |

| Manufacturing | Risk Management Specialist, Safety Manager, Insurance Risk Consultant | Identifying operational hazards, implementing safety protocols, negotiating insurance coverage | Safety standards, risk analysis, contract negotiation, incident investigation |

| Energy and Utilities | Risk Engineer, Insurance Analyst, Environmental Risk Manager | Evaluating environmental risks, managing property insurance, compliance with safety regulations | Environmental risk assessment, engineering principles, insurance policies, regulatory compliance |

| Technology | Cyber Risk Manager, Insurance Analyst, Risk Compliance Specialist | Assessment of cyber risks, managing insurance for technology assets, ensuring data protection compliance | Cybersecurity knowledge, insurance underwriting, regulatory compliance, data risk management |

Essential Skills for Success in Risk and Insurance Careers

Careers in Risk Management and Insurance demand a strong foundation in analytical thinking and problem-solving skills. Professionals must evaluate potential threats and develop strategies to minimize financial losses for organizations.

Effective communication and negotiation skills are crucial for success in this field, enabling collaboration with clients, underwriters, and regulatory agencies. Proficiency in data analysis tools and knowledge of regulatory compliance further enhance job performance in risk assessment and insurance management.

Advanced Career Paths and Specializations

Graduates with a Risk Management and Insurance degree can pursue advanced career paths such as Risk Analyst, Insurance Underwriter, and Claims Manager. Specialized roles include Enterprise Risk Manager, Actuary, and Compliance Officer, emphasizing strategic risk assessment and mitigation.

Expertise in advanced risk modeling and insurance law opens opportunities in Cyber Risk Management and Reinsurance Consulting. Professionals may also specialize in Financial Risk Management or Corporate Insurance Strategy to enhance organizational resilience and regulatory compliance.

Professional Certifications and Continuous Learning

A Risk Management and Insurance degree opens career opportunities in underwriting, claims adjusting, risk assessment, and insurance brokerage. Pursuing professional certifications such as CPCU (Chartered Property Casualty Underwriter) and ARM (Associate in Risk Management) enhances expertise and marketability. Your commitment to continuous learning through workshops and industry seminars ensures staying current with evolving regulations and risk mitigation strategies.

Industry Trends and Future Career Prospects

Risk Management and Insurance degrees open doors to careers in underwriting, claims adjusting, risk analysis, and actuarial science within the finance, healthcare, and corporate sectors. Industry trends highlight the rise of digital risk assessment tools, cyber insurance, and data-driven decision-making shaping future roles. Your career prospects are strong, with growing demand for professionals skilled in technology integration and regulatory compliance.

jobsintra.com

jobsintra.com