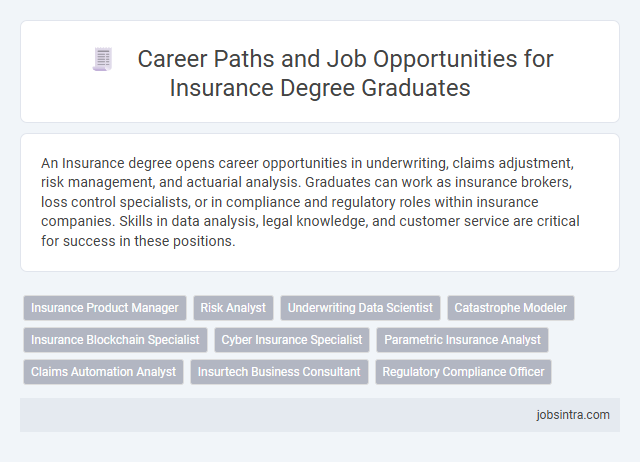

An Insurance degree opens career opportunities in underwriting, claims adjustment, risk management, and actuarial analysis. Graduates can work as insurance brokers, loss control specialists, or in compliance and regulatory roles within insurance companies. Skills in data analysis, legal knowledge, and customer service are critical for success in these positions.

Insurance Product Manager

An Insurance Product Manager drives the development and management of insurance policies, tailoring products to meet market demands and regulatory standards. You will analyze consumer needs, collaborate with cross-functional teams, and lead product launches to enhance profitability and customer satisfaction. Mastery of risk assessment, market trends, and insurance regulations is essential for success in this role.

Risk Analyst

A Risk Analyst uses analytical skills to assess and manage potential risks for insurance companies, helping to minimize financial losses. Your role involves evaluating data, forecasting risk trends, and advising on strategies to protect assets and ensure compliance. This career offers opportunities to work in underwriting, claims, and corporate risk management within the insurance industry.

Underwriting Data Scientist

Underwriting Data Scientists leverage advanced analytical skills to evaluate insurance risk by analyzing large datasets, identifying patterns, and creating predictive models. They collaborate with underwriting teams to refine risk assessment processes, enhancing accuracy and efficiency in policy pricing and claims management. Expertise in statistics, machine learning, and insurance principles is essential for optimizing decision-making and driving data-driven strategies in the insurance industry.

Catastrophe Modeler

A Catastrophe Modeler analyzes data to predict the impact of natural disasters on insurance portfolios, using advanced statistical and computational techniques. Your expertise in understanding risk assessment, loss modeling, and geographic information systems makes you essential in helping insurance companies mitigate potential financial losses. This role requires strong analytical skills and the ability to interpret complex data to improve disaster preparedness and pricing strategies.

Insurance Blockchain Specialist

An Insurance Blockchain Specialist leverages blockchain technology to enhance security, transparency, and efficiency in insurance processes such as claims management and fraud detection. This role requires expertise in both insurance principles and blockchain platforms, enabling you to design and implement decentralized solutions that reduce costs and streamline operations. Companies seek professionals who can bridge the gap between traditional insurance systems and innovative blockchain applications to drive industry transformation.

Cyber Insurance Specialist

Cyber Insurance Specialists assess and manage risks related to cyber threats and data breaches for insurance companies. They develop tailored policies to protect businesses from financial losses due to cyberattacks and ensure compliance with evolving regulations. Their expertise combines cybersecurity knowledge with insurance underwriting to provide comprehensive coverage solutions.

Parametric Insurance Analyst

A Parametric Insurance Analyst specializes in evaluating and managing insurance products that pay out based on predetermined parameters, such as weather events or natural disasters. They analyze data, develop risk models, and design policies that provide rapid and transparent claims settlements. This role requires strong analytical skills, expertise in actuarial science, and proficiency in data analytics tools to accurately assess and price parametric risks.

Claims Automation Analyst

A Claims Automation Analyst specializes in streamlining insurance claims processes by implementing and optimizing automated systems. This role involves analyzing data to identify inefficiencies, designing workflow improvements, and collaborating with IT teams to integrate advanced technologies like AI and machine learning. Expertise in insurance operations and technology enables this professional to enhance accuracy, reduce processing time, and improve customer satisfaction.

Insurtech Business Consultant

Insurtech Business Consultants specialize in integrating technology solutions to enhance insurance processes, improving efficiency and customer experience. They analyze market trends and technological advancements to recommend innovative digital strategies tailored to insurance companies. Their expertise bridges the gap between traditional insurance practices and emerging tech-driven business models.

Good to know: jobs for Insurance degree

Overview of Insurance Degree Programs

Insurance degree programs equip students with specialized knowledge in risk management, underwriting, and claims adjustment. These programs blend theoretical concepts with practical skills to prepare graduates for dynamic roles in the insurance industry.

Career opportunities for insurance degree holders include positions as actuaries, claims adjusters, underwriters, and risk analysts. Graduates can work in various sectors such as property and casualty, health, life, and reinsurance companies, as well as governmental agencies and consulting firms.

Core Skills Acquired Through Insurance Studies

An Insurance degree equips graduates with risk assessment, claims analysis, and policy evaluation skills essential in the insurance sector. These core competencies support roles such as underwriter, claims adjuster, and risk manager. Mastery of legal regulations, financial principles, and customer communication further enhances job performance in this field.

Traditional Career Paths in Insurance

What traditional career paths are available for graduates with an Insurance degree? Graduates can pursue roles such as underwriters, claims adjusters, and risk managers. These positions focus on evaluating risks, processing claims, and developing risk mitigation strategies within insurance companies.

Which job roles emphasize policy analysis and customer interaction in insurance? Insurance agents and brokers play a key role in advising clients on policy options and coverage needs. Their expertise ensures clients receive tailored insurance solutions that meet regulatory and financial requirements.

How does an Insurance degree prepare one for a career in actuarial science? Actuarial positions involve applying mathematics and statistics to assess risk and determine premium rates. Professionals in this field use data modeling to predict future events and maintain the financial stability of insurers.

Emerging Roles and Specializations

Insurance degree holders are increasingly exploring emerging roles such as Cyber Risk Analyst and Climate Risk Specialist. These positions address the growing demand for expertise in managing digital threats and environmental impacts.

Specializations in Data Analytics and Blockchain for Insurance are gaining prominence. Professionals with these skills optimize risk assessment and streamline claims processing through innovative technology solutions.

Opportunities Beyond the Insurance Industry

An Insurance degree equips graduates with risk assessment, analytical, and financial skills that are valuable in various sectors. These competencies open doors to careers beyond traditional insurance companies.

Opportunities extend into fields such as risk management, financial consulting, and compliance within banking and investment firms. Graduates can also pursue roles in healthcare administration, where understanding policy and liability is crucial. Moreover, corporate sectors seek insurance graduates for roles in strategic planning and internal auditing to mitigate organizational risks effectively.

Career Advancement and Professional Growth

An Insurance degree opens diverse career paths in underwriting, risk management, and claims adjustment, offering robust opportunities for professional development. Focused expertise in this field enhances career advancement through specialized certifications and leadership roles.

- Underwriting Specialist - Assesses insurance applications and risks to determine coverage eligibility and premium pricing, fostering skill growth in risk analysis.

- Risk Manager - Develops strategies to minimize financial losses for organizations, promoting leadership and strategic planning experience.

- Claims Adjuster - Investigates insurance claims to ensure fair compensation, building expertise in negotiation and regulatory compliance.

Job Market Trends and Future Outlook

The insurance industry offers diverse career paths such as underwriting, risk management, and claims adjusting, driven by evolving market demands. Job market trends indicate rising opportunities in cyber insurance, data analysis, and compliance roles due to increasing regulatory requirements and digital transformation. Your skills in insurance can position you for growth in these expanding sectors, with a future outlook highlighting steady employment and innovation-driven roles.

jobsintra.com

jobsintra.com