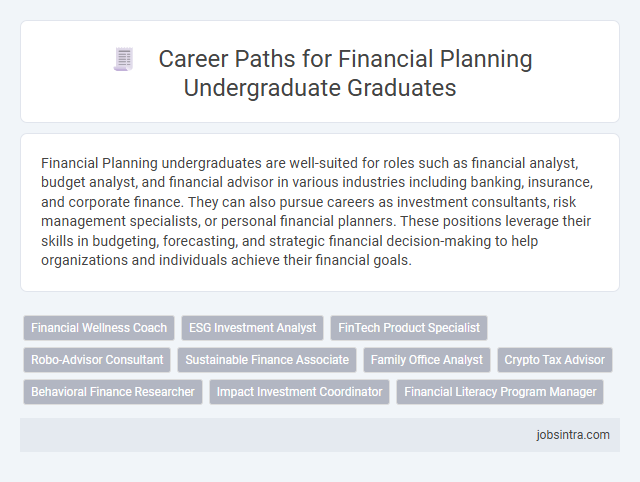

Financial Planning undergraduates are well-suited for roles such as financial analyst, budget analyst, and financial advisor in various industries including banking, insurance, and corporate finance. They can also pursue careers as investment consultants, risk management specialists, or personal financial planners. These positions leverage their skills in budgeting, forecasting, and strategic financial decision-making to help organizations and individuals achieve their financial goals.

Financial Wellness Coach

A Financial Wellness Coach helps individuals develop personalized strategies to manage their finances effectively, promoting long-term financial health. They assess clients' spending habits, budgeting skills, and financial goals to create tailored plans that improve financial literacy and reduce stress. This role offers a meaningful career path for Financial Planning undergraduates seeking to empower others through financial education and support.

ESG Investment Analyst

ESG Investment Analysts specialize in evaluating environmental, social, and governance factors to guide sustainable investment strategies. This role requires strong analytical skills and a deep understanding of financial markets combined with ESG criteria to identify risks and opportunities. Your ability to integrate ESG considerations into financial planning enhances responsible investment decisions and drives long-term value creation.

FinTech Product Specialist

FinTech Product Specialists leverage their financial planning expertise to design and enhance digital financial solutions that meet market demands. Your role involves collaborating with development teams to create user-friendly products that simplify financial decision-making frameworks for clients. This career path offers opportunities to bridge finance and technology, driving innovation in financial services.

Robo-Advisor Consultant

A Robo-Advisor Consultant leverages expertise in financial planning and technology to design and improve automated investment platforms tailored to client needs. This role involves analyzing algorithmic strategies, optimizing portfolio management, and enhancing user experiences to ensure efficient and personalized financial advice. Your skills in data analysis, market trends, and client communication are essential for driving innovation in digital wealth management solutions.

Sustainable Finance Associate

A Sustainable Finance Associate supports the integration of environmental, social, and governance (ESG) criteria into investment strategies to drive responsible financial decision-making. They analyze market trends, assess sustainability risks, and collaborate with stakeholders to promote ethical investment portfolios. This role is ideal for Financial Planning graduates seeking to influence positive social and environmental impact through finance.

Family Office Analyst

A Family Office Analyst plays a critical role in managing and analyzing the financial portfolios of high-net-worth families, ensuring diversified investments and strategic asset allocation. You will be responsible for conducting in-depth financial research, preparing detailed reports, and supporting wealth preservation and growth through tailored financial planning. This position leverages your expertise in finance to deliver personalized solutions that align with the family's long-term goals and values.

Crypto Tax Advisor

A Financial Planning undergraduate can excel as a Crypto Tax Advisor by leveraging their understanding of tax regulations and digital assets. This role involves analyzing cryptocurrency transactions to ensure compliance with tax laws and optimizing your clients' tax liabilities. Expertise in blockchain technology combined with tax planning skills positions you to guide individuals and businesses through complex crypto tax challenges.

Behavioral Finance Researcher

A Financial Planning undergraduate can excel as a Behavioral Finance Researcher by analyzing how psychological factors influence financial decision-making. This role involves studying patterns in investor behavior to develop strategies that improve financial planning and risk management. Your insights can help create more effective financial models that align with real-world human behavior.

Impact Investment Coordinator

An Impact Investment Coordinator plays a pivotal role in managing and directing investments that generate positive social and environmental outcomes alongside financial returns. Your expertise in financial planning equips you to analyze potential impact investments, assess risks, and align portfolios with sustainability goals. Working in this role involves collaboration with nonprofits, investors, and stakeholders to drive meaningful change through strategic funding decisions.

Good to know: jobs for Financial Planning undergraduate

Overview of Financial Planning as a Career

What career opportunities are available for Financial Planning undergraduates? Financial Planning offers diverse roles including financial analyst, investment advisor, and wealth manager. These positions emphasize strategic decision-making to help clients achieve their financial goals.

How does a Financial Planning career impact business success? Effective financial planning drives business growth by managing budgets, forecasting trends, and optimizing resource allocation. This essential function supports sustainable and profitable business operations.

What skills do Financial Planning undergraduates develop for their careers? Core skills include data analysis, risk assessment, and client communication. These capabilities enable professionals to deliver tailored financial strategies and foster trust with clients.

Why is Financial Planning a promising career path in the business world? The increasing complexity of financial markets creates a high demand for skilled planners. Your expertise can guide individuals and corporations through economic challenges and opportunities.

Top Entry-Level Roles for Financial Planning Graduates

Financial Planning undergraduates possess analytical skills and knowledge essential for managing finances and investments. Entry-level positions offer practical experience and a pathway to professional certifications.

Top roles include Financial Analyst, where you evaluate financial data to support business decisions. Another common position is Junior Financial Planner, assisting clients with budgeting and retirement planning.

Essential Skills and Qualifications for Success

Financial Planning undergraduates possess a strong foundation in budgeting, investment analysis, and risk management. These skills enable them to develop comprehensive financial plans tailored to individual or organizational goals.

Essential skills include proficiency in financial modeling, data analysis, and effective communication to explain complex financial concepts clearly. Qualifications such as a degree in finance, certifications like CFP (Certified Financial Planner), and internships enhance job prospects. Success requires analytical thinking, attention to detail, and the ability to stay updated with market trends and regulatory changes.

Key Industries Hiring Financial Planning Graduates

Financial Planning graduates possess analytical skills essential for roles in banking, insurance, and investment firms. These key industries prioritize financial advisors, risk analysts, and portfolio managers to optimize client wealth and manage financial risks.

Corporate finance departments and consulting firms also actively hire financial planning undergraduates to support budgeting, forecasting, and strategic resource allocation. Opportunities in real estate and fintech sectors are growing rapidly as demand rises for financial planning expertise in innovative market solutions.

Certification and Licensing Pathways

Financial Planning undergraduates can pursue careers as Certified Financial Planners (CFP), Investment Advisors, or Financial Analysts. Obtaining certifications like the CFP, Chartered Financial Analyst (CFA), and Securities licenses such as Series 7 or Series 66 enhances job prospects and credibility. Licensing pathways often involve passing standardized exams and meeting experience requirements, essential for roles in financial advisory and wealth management firms.

Career Advancement Opportunities

Financial Planning undergraduates gain access to diverse job roles that pave the way for significant career advancement opportunities. These roles develop essential skills in client management, investment strategies, and risk assessment crucial for senior positions.

- Financial Advisor - Builds personalized financial plans for clients, creating a foundation for progression into senior advisory or wealth management roles.

- Investment Analyst - Evaluates market trends and investment portfolios, providing a pathway to portfolio management or financial consultancy positions.

- Risk Management Specialist - Identifies and mitigates financial risks, enabling advancement into strategic risk assessment or compliance leadership roles.

Emerging Trends in Financial Planning Careers

Financial Planning undergraduates are increasingly in demand for roles such as financial analysts, wealth management advisors, and risk assessment specialists. Emerging trends highlight the integration of technology like AI-driven financial tools and sustainable investment strategies shaping career opportunities. Your skills in data analysis and personalized financial advising position you well to excel in these evolving fields.

jobsintra.com

jobsintra.com