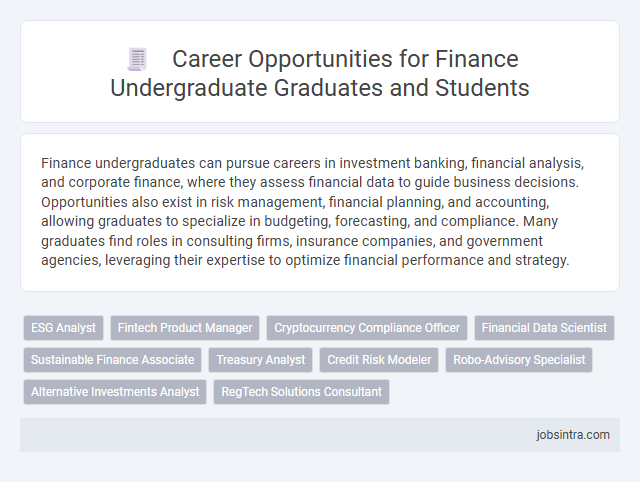

Finance undergraduates can pursue careers in investment banking, financial analysis, and corporate finance, where they assess financial data to guide business decisions. Opportunities also exist in risk management, financial planning, and accounting, allowing graduates to specialize in budgeting, forecasting, and compliance. Many graduates find roles in consulting firms, insurance companies, and government agencies, leveraging their expertise to optimize financial performance and strategy.

ESG Analyst

Finance undergraduates can pursue a career as an ESG Analyst, specializing in evaluating companies based on environmental, social, and governance criteria. This role involves analyzing sustainability reports, assessing ethical practices, and providing investment recommendations that align with responsible and impact-driven goals. ESG Analysts play a crucial role in guiding businesses and investors towards long-term value creation and risk management through sustainable finance strategies.

Fintech Product Manager

Finance undergraduates pursuing a career as Fintech Product Managers leverage their analytical skills and financial knowledge to develop innovative digital financial products. They collaborate with cross-functional teams to design, launch, and optimize technology-driven solutions that meet market demands and regulatory requirements. Expertise in user experience, market trends, and financial technology platforms is essential for driving product success in this rapidly evolving industry.

Cryptocurrency Compliance Officer

Cryptocurrency Compliance Officers play a pivotal role in ensuring financial institutions adhere to the evolving regulatory landscape of digital assets. This position requires a deep understanding of blockchain technology, anti-money laundering (AML) laws, and risk management strategies specific to cryptocurrencies. Your expertise in finance and regulatory compliance can drive secure and transparent operations in this rapidly growing sector.

Financial Data Scientist

A career as a Financial Data Scientist leverages your finance background with advanced data analysis, machine learning, and statistical modeling skills to interpret complex financial datasets. This role involves developing predictive models to guide investment strategies, risk management, and market trend analysis, making you indispensable in decision-making processes. Expertise in programming languages like Python or R complements your financial acumen to drive data-driven insights that enhance business performance.

Sustainable Finance Associate

A Sustainable Finance Associate focuses on integrating environmental, social, and governance (ESG) criteria into financial analysis and investment decisions, promoting responsible and ethical practices. Your role often involves assessing sustainability risks, supporting green financing initiatives, and helping organizations align their financial strategies with global sustainability goals. This position blends financial expertise with a commitment to creating long-term positive impact on the environment and society.

Treasury Analyst

Treasury Analysts play a critical role in managing a company's cash flow, liquidity, and financial risk. They analyze financial data to optimize cash management, forecast cash needs, and ensure efficient capital allocation. This position demands strong analytical skills and a deep understanding of financial markets, making it an ideal career path for finance undergraduates seeking to influence corporate financial strategy.

Credit Risk Modeler

Credit Risk Modelers analyze financial data to assess the risk of lending to individuals or businesses, using statistical techniques and machine learning algorithms. You can expect to develop predictive models that help financial institutions minimize losses by identifying potential defaulters. This role suits Finance undergraduates with strong quantitative skills and an interest in data-driven decision making.

Robo-Advisory Specialist

Finance undergraduates can excel as Robo-Advisory Specialists by leveraging their knowledge of financial markets and investment strategies to develop automated portfolio management systems. These specialists design algorithms that provide personalized investment advice, optimize asset allocation, and enhance client experience through technology-driven solutions. Proficiency in data analysis, programming, and financial modeling is essential to succeed in this innovative role within the fintech industry.

Alternative Investments Analyst

Finance undergraduates can pursue a career as an Alternative Investments Analyst, specializing in evaluating non-traditional assets such as private equity, hedge funds, real estate, and commodities. This role involves conducting due diligence, market research, and risk assessment to identify promising investment opportunities outside conventional markets. Expertise in financial modeling, data analysis, and an understanding of alternative markets are essential for success in this dynamic field.

Good to know: jobs for Finance undergraduate

Emerging Career Paths in Finance for Undergraduates

Finance undergraduates are discovering numerous emerging career paths that blend traditional financial knowledge with innovative technologies and data analysis. These roles offer dynamic opportunities in sectors transforming the financial landscape.

- Financial Data Analyst - Focuses on interpreting complex financial data to support strategic decision-making in businesses and investment firms.

- Fintech Product Manager - Oversees the development of financial technology products, combining finance expertise with project management and market insights.

- Environmental, Social, and Governance (ESG) Analyst - Evaluates companies' sustainability practices and ESG risks to guide ethical investment strategies.

Finance undergraduates equipped with analytical skills and technological proficiency will thrive in these fast-evolving financial careers.

In-Demand Skills for Finance Graduates

Finance graduates possess a strong foundation in financial principles, preparing them for diverse career opportunities across industries. Mastery of in-demand skills enhances their ability to meet market needs and secure competitive roles.

- Data Analysis - Ability to interpret financial data supports strategic decision-making and risk management.

- Financial Modeling - Creating accurate models enables forecasting and valuation critical for investment and corporate finance roles.

- Regulatory Knowledge - Understanding compliance standards ensures adherence to legal requirements in finance operations.

Top Industries Hiring Finance Majors

Finance undergraduates have diverse career opportunities across multiple industries. Top industries hiring finance majors include banking, investment management, insurance, and corporate finance. These sectors seek professionals skilled in financial analysis, risk management, and strategic planning to drive business growth and profitability.

Entry-Level Job Roles in Finance

What entry-level job roles are available for Finance undergraduates? Finance graduates can start as financial analysts, investment analysts, or credit analysts. These positions provide foundational experience in financial data interpretation and decision-making.

How important is gaining practical experience in entry-level finance roles? Hands-on experience develops critical skills in budgeting, forecasting, and risk assessment. Employers often seek candidates who demonstrate proficiency through internships or project work.

Which sectors commonly hire Finance undergraduates for entry-level positions? Banking, insurance, and corporate finance sectors are primary employers of new graduates. These industries offer diverse opportunities to apply financial knowledge in real-world scenarios.

What skills enhance employability in entry-level finance jobs? Strong analytical abilities, proficiency in Excel, and effective communication are key. Mastery of financial software also increases your competitiveness in the job market.

How can entry-level finance roles help build a career path? Starting roles lay the groundwork for advanced positions like financial manager or portfolio manager. Early career experiences shape expertise and open doors to leadership roles.

Certifications to Boost Finance Careers

Finance undergraduates have diverse job opportunities across banking, investment, and corporate finance sectors. Obtaining certain certifications can significantly enhance your career prospects and credibility in the finance industry.

- Certified Financial Analyst (CFA) - This certification is highly regarded for investment management and equity research roles.

- Certified Public Accountant (CPA) - Ideal for careers in accounting, auditing, and taxation within finance.

- Financial Risk Manager (FRM) - Focused on risk assessment, this certification is valuable for risk management positions in financial institutions.

Networking and Internship Opportunities

| Job Titles for Finance Undergraduates | Networking Opportunities | Internship Opportunities |

|---|---|---|

| Financial Analyst | Attend finance industry conferences and seminars to connect with professionals and recruiters. | Intern at investment banks, corporate finance departments, or consulting firms to gain hands-on experience. |

| Investment Banking Analyst | Join finance clubs and student investment groups at university to build peer networks. | Secure internships at major banks or boutique advisory firms focused on mergers and acquisitions. |

| Corporate Finance Associate | Participate in networking events hosted by financial companies and alumni associations. | Internships with corporations in finance departments specializing in budgeting, forecasting, and financial planning. |

| Risk Management Analyst | Connect with risk management and insurance professionals through specialized workshops and webinars. | Intern with insurance companies, risk assessment firms, or regulatory agencies. |

| Financial Planner | Engage in networking through professional organizations like the CFP Board or local financial planning chapters. | Intern at financial advisory firms or wealth management companies to understand client portfolio management. |

Future Trends in Finance Employment

Finance undergraduates are increasingly sought after for roles in financial technology, risk management, and data analytics. The rise of artificial intelligence and blockchain technology is transforming traditional finance jobs, creating demand for professionals skilled in these areas. Careers in sustainable finance and ESG (Environmental, Social, Governance) investing are expanding rapidly as businesses prioritize ethical and long-term value creation.

jobsintra.com

jobsintra.com