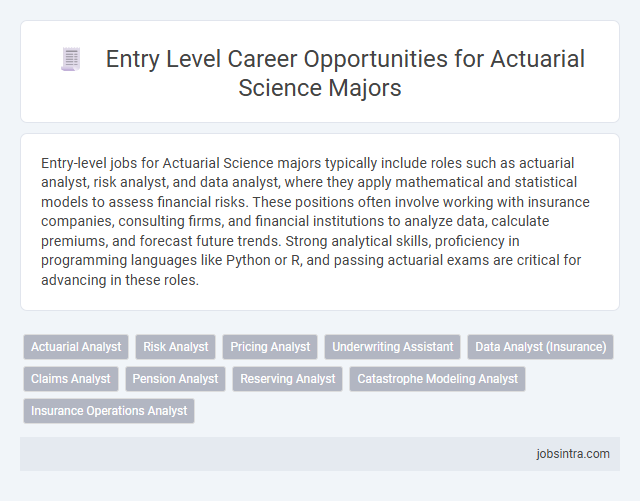

Entry-level jobs for Actuarial Science majors typically include roles such as actuarial analyst, risk analyst, and data analyst, where they apply mathematical and statistical models to assess financial risks. These positions often involve working with insurance companies, consulting firms, and financial institutions to analyze data, calculate premiums, and forecast future trends. Strong analytical skills, proficiency in programming languages like Python or R, and passing actuarial exams are critical for advancing in these roles.

Actuarial Analyst

Actuarial Analysts play a crucial role in assessing financial risks by analyzing statistical data and creating models to predict future events. Your work involves applying mathematical and statistical techniques to evaluate insurance claims, pension plans, and investment strategies, helping companies make informed decisions. Entry-level positions often provide hands-on experience with data analysis tools and exposure to regulatory requirements, paving the way for professional actuarial exams.

Risk Analyst

Risk Analysts in the actuarial science field assess financial risks using statistical models and data analysis to help organizations minimize potential losses. They collaborate with insurance companies, banks, and consultancy firms to evaluate the likelihood of events like accidents, natural disasters, or market fluctuations. Proficiency in mathematics, probability, and computer software such as Excel and SQL is essential for entry-level positions in this role.

Pricing Analyst

Entry-level Actuarial Science majors often begin their careers as Pricing Analysts, where they evaluate risk and determine insurance premiums using statistical data and financial models. This role requires strong analytical skills to analyze market trends, loss data, and competitor pricing to recommend accurate rates. Pricing Analysts collaborate with underwriters and actuaries to develop competitive pricing strategies that balance profitability and market share.

Underwriting Assistant

Entry-level Underwriting Assistant positions offer Actuarial Science majors valuable exposure to risk assessment and policy evaluation in insurance firms. You will support underwriters by analyzing data, preparing reports, and ensuring accurate documentation to streamline decision-making processes. This role builds foundational skills in risk management and financial analysis, essential for advancing in actuarial careers.

Data Analyst (Insurance)

Entry-level actuarial science majors often find opportunities as Data Analysts in the insurance sector, where they utilize statistical software to interpret complex datasets related to risk assessment and policy performance. These roles require strong analytical skills to support underwriting decisions, pricing strategies, and claims forecasting. Mastery of data visualization tools and knowledge of insurance regulations enhance the effectiveness of their insights in driving business strategies.

Claims Analyst

Entry-level Actuarial Science majors often find roles as Claims Analysts, where they evaluate insurance claims to determine their validity and financial impact. This position requires strong analytical skills and the ability to interpret complex data to assist in risk assessment and cost management. Your expertise in statistical modeling and data analysis can drive accurate predictions and improve decision-making processes in insurance companies.

Pension Analyst

Pension Analysts evaluate and manage retirement plans, ensuring compliance with regulations and financial stability. They analyze demographic data and actuarial assumptions to calculate pension liabilities and recommend funding strategies. Entry-level positions in this role require strong analytical skills and a foundation in actuarial principles.

Reserving Analyst

Entry-level Reserving Analysts in Actuarial Science focus on estimating insurance liabilities and preparing financial reports to ensure adequate reserves. They analyze historical loss data and use statistical models to predict future claim payouts, supporting an insurer's financial stability. Proficiency in data analysis and strong attention to detail are essential for success in this role.

Catastrophe Modeling Analyst

Entry-level Catastrophe Modeling Analysts use statistical and mathematical skills to assess risks from natural disasters and predict potential financial impacts. Your role involves analyzing data, running simulations, and supporting insurance companies in managing catastrophe exposure. Strong knowledge in programming, data analysis, and actuarial principles is essential for success in this position.

Good to know: jobs for Actuarial Science majors entry level

Overview of Actuarial Science as a Career Path

Actuarial Science majors develop strong analytical and statistical skills essential for risk assessment in finance and insurance industries. Entry-level jobs typically involve data analysis, financial modeling, and risk evaluation.

Common positions include actuarial analyst, junior actuary, and risk assistant, where candidates work with experience tables and predictive models. These roles require proficiency in mathematics, statistics, and specialized software like Excel, SAS, or R. The career path offers growth potential into senior actuarial roles, consulting, and management within insurance companies, pension funds, and financial institutions.

Key Skills Required for Entry-Level Actuarial Positions

Entry-level actuarial science jobs often include roles such as actuarial analyst, risk analyst, and pricing analyst within insurance companies, consulting firms, and financial institutions. Key skills required include proficiency in mathematics and statistics, strong analytical capabilities, and expertise in actuarial software like Excel, SAS, or R. Effective communication skills and a solid understanding of risk assessment and financial modeling are crucial for success in these positions.

Common Entry-Level Job Titles for Actuarial Science Majors

| Job Title | Description | Key Skills |

|---|---|---|

| Actuarial Analyst | Supports senior actuaries by analyzing statistical data to assess risk and financial costs for insurance and finance companies. | Probability, statistics, Excel, data analysis, actuarial software |

| Risk Analyst | Evaluates financial risks for organizations, focusing on minimizing potential losses through quantitative methods. | Risk modeling, financial analysis, VBA, data interpretation |

| Insurance Underwriter | Analyzes insurance applications to determine coverage eligibility and pricing based on actuarial data. | Risk assessment, underwriting guidelines, communication, attention to detail |

| Pricing Analyst | Develops pricing strategies for insurance products using actuarial models and market data. | Pricing models, Excel, market research, statistics |

| Data Analyst (Actuarial) | Processes and interprets large datasets to support actuarial predictions and financial decision-making. | SQL, Python, data visualization, statistical software |

Top Industries Hiring Actuarial Graduates

Actuarial Science majors have strong entry-level opportunities across various industries that value risk assessment and financial forecasting. Top employers seek candidates skilled in mathematics, statistics, and financial theory to support business decision-making.

- Insurance Industry - The largest employer of actuarial graduates, focusing on life, health, property, and casualty insurance risk analysis.

- Consulting Firms - Provide actuaries to help clients with risk management, financial modeling, and regulatory compliance.

- Financial Services - Banks, investment firms, and pension funds hire actuaries to optimize portfolio risk and develop retirement plans.

Professional Certifications and Their Importance

Entry-level jobs for Actuarial Science majors often emphasize the importance of professional certifications to advance in the business sector. These certifications validate expertise and enhance job prospects across insurance, finance, and risk management fields.

- Actuarial Analyst - Involves data analysis and risk assessment, requiring progress in exams such as SOA's Probability (P) or CAS's Exam 1 for credibility.

- Risk Consultant - Focuses on identifying and mitigating business risks, where credentials like the Associate of the Society of Actuaries (ASA) increase employability.

- Insurance Underwriter - Evaluates insurance applications using actuarial principles, with professional certifications from the Casualty Actuarial Society (CAS) enhancing career growth.

Career Growth and Advancement Opportunities

Actuarial Science majors often begin their careers as actuarial analysts or junior actuaries, roles that emphasize risk assessment and financial forecasting. These entry-level positions provide hands-on experience with statistical models and insurance industry practices.

Career growth in actuarial science is robust, with clear advancement paths to senior actuary, consulting actuary, or risk manager positions. Professional certifications, such as those from the Society of Actuaries or Casualty Actuarial Society, significantly enhance your promotion prospects and earning potential.

Tips for Securing an Entry-Level Actuarial Role

What are the common entry-level jobs available for Actuarial Science majors? Actuarial analyst and junior actuary positions are the most accessible roles for recent graduates. These roles typically involve risk assessment, data analysis, and financial forecasting.

How can Actuarial Science majors prepare to secure an entry-level actuarial job? Obtaining relevant certifications such as the Society of Actuaries (SOA) or Casualty Actuarial Society (CAS) exams significantly improves employability. Internships and practical experience in insurance or finance sectors enhance job candidacy.

What skills do employers prioritize for entry-level actuarial roles? Proficiency in statistics, mathematics, and programming languages like R, Python, or SQL is essential. Strong communication skills help translate complex data into actionable business insights.

How important is networking for landing an entry-level actuarial position? Building connections through actuarial clubs, industry seminars, and professional organizations can open doors to job opportunities. Networking often leads to referrals and insights into unadvertised roles.

What role does a tailored resume play in securing an actuarial job? Highlighting relevant coursework, exam progress, and internship experience demonstrates commitment and technical ability. Using keywords from job descriptions increases chances of passing applicant tracking systems (ATS).

jobsintra.com

jobsintra.com